Evaluating the Long Term Cost of Electric Vehicle Ownership

Resale Value and Depreciation

Understanding Resale Value

When making major purchases like vehicles or appliances, savvy buyers always consider how much value the item will retain over time. The resale value represents what you can realistically expect to get when selling a used item, and it's influenced by everything from physical condition to market trends. While predicting exact future values is impossible, understanding these factors helps make smarter purchasing decisions.

Market demand fluctuates constantly - what's highly desirable today might be outdated tomorrow. Items with timeless appeal or practical functionality tend to hold value better than those tied to passing trends.

Factors Affecting Resale Value

Condition tops the list of what determines an item's resale price. A vehicle with complete service records and minimal wear will always sell for more than an identical model that's been poorly maintained. Special features can also boost value - premium sound systems in cars or commercial-grade components in appliances often command higher resale prices.

External economic factors play a major role too. During fuel price spikes, fuel-efficient vehicles see resale values rise, while economic downturns might increase demand for affordable used goods across the board.

Depreciation: A Natural Occurrence

All physical assets lose value over time through depreciation. This financial reality affects everything from office equipment to home electronics. Understanding depreciation patterns helps buyers make informed decisions about when to purchase and when to sell.

For example, most vehicles lose about 20% of their value in the first year, then depreciate more slowly afterward. This knowledge might lead someone to buy a one-year-old used car rather than a new one.

Calculating Depreciation

Businesses use several methods to calculate depreciation for accounting purposes. The straight-line method spreads the cost evenly over an asset's lifespan, while accelerated methods like double-declining balance match the typical pattern where assets lose more value early on.

Consumers can use simpler approaches - tracking average resale prices for similar items of different ages provides practical depreciation estimates for personal financial planning.

Predicting Future Resale Value

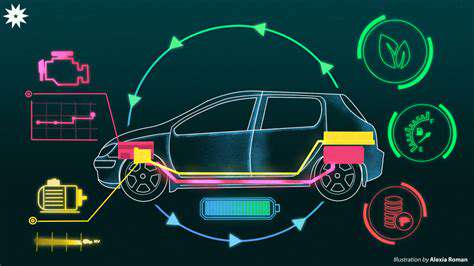

While precise predictions are impossible, certain strategies improve estimates. Researching historical resale values for similar items reveals typical depreciation patterns. Monitoring industry trends helps anticipate changes - for instance, growing environmental concerns might increase future resale values for electric vehicles.

The most accurate predictions combine multiple data sources with realistic expectations about market conditions.

The Role of Market Research

Serious investors and careful consumers alike benefit from thorough market research. Checking multiple resale platforms reveals current pricing trends, while industry reports highlight emerging technologies that might make certain products obsolete.

Regular market monitoring helps identify the optimal times to buy or sell, maximizing value for both personal and business assets.

Resale Value and Investment Decisions

Considering resale value transforms purchasing from a simple transaction into a strategic financial decision. Whether buying equipment for a business or major appliances for a home, evaluating potential resale value helps calculate the true long-term cost of ownership.

This perspective often reveals surprising value in higher-quality items that retain their worth, compared to cheaper alternatives that might need frequent replacement.

Tax Credits and Incentives

Tax Credits for Low-Income Families

For families struggling to make ends meet, tax credits like the Earned Income Tax Credit (EITC) provide crucial financial support. These programs recognize that helping working families benefits entire communities by reducing poverty and stimulating local economies.

The EITC's structure particularly helps families with children, providing larger credits that acknowledge the added expenses of raising kids. Many eligible families don't claim these benefits simply because they don't know about them.

Incentives for Renewable Energy Investments

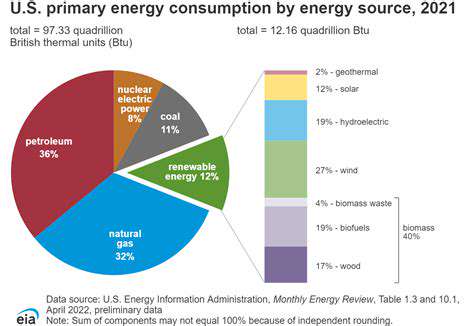

Governments worldwide use tax incentives to accelerate the transition to clean energy. Homeowners installing solar panels often qualify for substantial credits that reduce payback periods from a decade to just a few years, making renewable energy accessible to more households.

These policies don't just benefit individual homeowners - they drive innovation in the clean tech sector while reducing overall carbon emissions.

Tax Breaks for Small Businesses

Local economies thrive when small businesses succeed. Tax deductions for expenses like equipment purchases and employee training help these businesses grow while creating jobs. Many communities offer additional incentives for businesses that locate in underserved areas, spreading economic opportunities more evenly.

Seasonal businesses particularly benefit from provisions that help smooth out cash flow during off-peak months.

Incentives for Education and Training

Lifelong learning has become essential in today's rapidly changing job market. Tax benefits for education encourage workers to gain new skills, making them more valuable employees while strengthening the overall workforce.

These incentives often cover more than just traditional college tuition, with many programs applying to vocational training, professional certifications, and even some online courses.

Tax Credits for Adoption and Foster Care

Adopting or fostering a child brings life-changing joy along with significant expenses. Tax credits help offset costs like legal fees and home modifications, making it possible for more families to provide loving homes. These policies recognize that supporting adoptive families ultimately benefits society as a whole.

Some states offer additional credits beyond federal provisions, particularly for adopting older children or those with special needs.

Read more about Evaluating the Long Term Cost of Electric Vehicle Ownership

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies