Upcoming Changes in European EV Subsidy Programs

Understanding the Current Landscape

European countries have rolled out a patchwork of incentives to boost electric vehicle (EV) adoption, from tax credits to infrastructure grants. But this fragmented approach creates confusion for consumers trying to compare options across borders. The lack of standardization means buyers might miss out on the best deals simply because they don't understand the varying programs.

The Impact on the EV Market

While subsidies have clearly accelerated EV sales, they've also created unintended market distortions. Countries with more generous incentives see disproportionate adoption rates, potentially stunting growth in neighboring markets. This uneven development raises questions about whether subsidies are creating artificial demand rather than sustainable market growth.

Potential Drivers Behind Upcoming Changes

Several forces are reshaping Europe's EV subsidy landscape. Budget pressures compete with climate commitments, while policymakers grapple with how to phase out incentives without disrupting the emerging EV ecosystem. The push for more equitable access to clean transportation is adding another layer of complexity to these decisions.

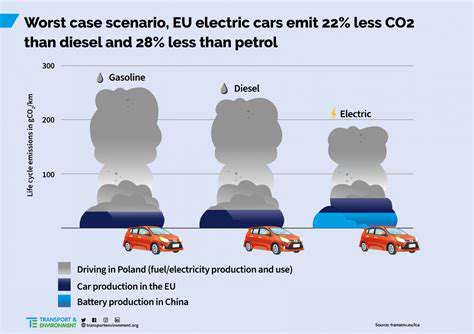

Concerns Regarding Sustainability and Equity

Current subsidy structures often favor wealthier early adopters who can afford premium EVs, raising questions about social equity. There's growing recognition that incentives must evolve to support broader access while ensuring environmental benefits aren't undermined by increased electricity demand.

The Role of International Collaboration

The current patchwork of national policies creates inefficiencies that could be addressed through greater EU coordination. Standardized incentive structures and shared infrastructure planning could reduce costs while preventing a subsidy race to the bottom between member states.

Phased Withdrawals and Reformulations of Existing Schemes

Phased Withdrawals

Gradual phase-outs allow markets to adjust without sudden shocks. This approach gives automakers time to adapt production while preventing used EV values from collapsing. The step-down method also provides natural experiment points to assess what incentive levels actually drive adoption.

Reformulations of Existing Schemes

New incentive structures are shifting from blanket subsidies to targeted support. Means-testing, regional adjustments, and charging infrastructure requirements are becoming common features. The smartest reforms link incentives directly to verifiable emissions reductions rather than simple EV purchases.

Impact on Beneficiaries

Transition periods create uncertainty, but clear communication can mitigate disruptions. Forward-looking governments are providing multi-year outlooks on incentive reductions, allowing both consumers and businesses to plan accordingly.

Financial Implications

The fiscal burden of EV subsidies has become unsustainable for some governments. New models are emerging that shift costs to carbon pricing or electricity rate structures, creating more stable long-term funding mechanisms.

Regulatory Alignment

As the EU tightens emissions standards, national incentives must evolve from demand-side boosts to supply-side supports that help manufacturers meet tougher requirements.

Stakeholder Engagement

Effective transitions require ongoing dialogue with automakers, utilities, and consumer groups. The most successful policy changes emerge from collaborative working groups rather than top-down mandates.

Focus on Charging Infrastructure and Battery Technology

Charging Infrastructure Expansion

Europe's charging network growth is shifting from quantity to quality. New installations prioritize strategic locations over simple density metrics, with smart charging capabilities becoming standard. The focus is now on creating seamless cross-border charging experiences rather than isolated national networks.

Battery Technology Advancements

Breakthroughs in solid-state batteries and advanced thermal management systems are extending ranges while improving safety. Perhaps more importantly, second-life applications for EV batteries are emerging as a key sustainability solution.

Policy and Regulatory Changes

New regulations are mandating interoperable payment systems and standardized connectors across Europe. This removes one of the last major friction points for cross-border EV travel.

Consumer Acceptance and Adoption

Education campaigns are shifting from general awareness to practical guidance. Potential buyers now want clear information about real-world range, charging times, and total cost of ownership comparisons.

Integration with Existing Infrastructure

Smart grid technologies are enabling EVs to become grid assets rather than just loads. Vehicle-to-grid (V2G) pilots show how EVs can actually support renewable energy integration.

Economic Impact and Job Creation

The charging infrastructure boom is creating new service sector jobs that can't be outsourced, from installation technicians to maintenance crews. This local economic benefit is becoming a key political driver for continued investment.

Impact on EV Sales and Market Dynamics

Accelerating EV Adoption

The EV revolution is entering its mass-market phase. We're no longer just seeing early adopters - mainstream buyers are now comparing EVs directly with conventional vehicles on total cost of ownership. This shift is forcing automakers to rethink everything from dealership training to financing options.

Market Competition and Innovation

The competitive landscape is bifurcating between premium technology leaders and budget-focused volume producers. This mirrors the traditional auto market but with much faster product cycles and more disruptive entrants.

Infrastructure Development

Charging networks are evolving from standalone stations to integrated mobility hubs featuring retail, dining, and workspaces. This transforms charging from a necessary evil into a potential profit center.

Government Policies and Regulations

The most effective policies are now focusing on removing barriers rather than just offering handouts. Streamlined permitting for home chargers and right-to-charge laws for apartment dwellers are proving more impactful than pure purchase incentives.

Future Outlook and Potential Challenges

The next frontier involves addressing mineral supply chains and recycling infrastructure. Without solutions in these areas, the environmental benefits of EVs could be undermined by resource constraints.

Read more about Upcoming Changes in European EV Subsidy Programs

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies