Analyzing China's EV Subsidy Policy and Its Global Impact

The Subsidy's Impact on the Chinese EV Market

The Subsidy's Effect on Domestic Production

China's government subsidies have created tangible benefits for domestic manufacturers. These financial incentives directly reduce operational expenses, allowing companies to reinvest in workforce expansion and production scaling. The renewable energy sector provides clear evidence of this phenomenon, with solar panel manufacturers achieving unprecedented output levels following targeted government support.

Manufacturers receiving subsidies often allocate funds toward modernizing equipment and implementing lean production techniques. While these developments stimulate economic activity, industry analysts caution about potential inventory gluts if production volumes outpace actual market demand.

The Subsidy's Influence on Export Competitiveness

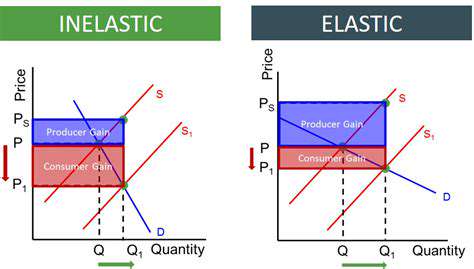

Chinese exporters gain distinct pricing advantages through production subsidies. This cost reduction enables aggressive international pricing strategies that frequently undercut competitors in North American and European markets. Automotive component exporters, particularly those specializing in EV batteries, have leveraged this advantage to capture significant global market share.

Trade experts note increasing scrutiny from WTO members regarding China's subsidy practices. Some nations have implemented countervailing duties to neutralize the perceived unfair advantage, creating complex trade dynamics that require careful diplomatic navigation.

Impact on Consumer Prices and Affordability

Subsidy programs create ripple effects throughout consumer markets. When effectively structured, these programs can reduce retail prices by 15-20% for subsidized goods like electric vehicles and home solar systems. The Chinese NEV (New Energy Vehicle) market demonstrates this principle, with entry-level EV prices becoming increasingly accessible to middle-class consumers.

However, pricing benefits don't always reach end consumers uniformly. Some manufacturers choose to maintain price points while improving profit margins, particularly in markets with limited competition. Regulatory oversight plays a crucial role in ensuring subsidy benefits actually reach target populations.

The Subsidy's Role in Technological Advancement

China's subsidy framework actively promotes innovation through R&D tax credits and direct research grants. This strategic approach has yielded breakthroughs in battery energy density and charging speed, with Chinese companies now leading in several key EV technology metrics. The government's Made in China 2025 plan specifically directs subsidies toward next-generation automotive technologies.

Environmental Concerns and Sustainability

While promoting green technology, some subsidy programs inadvertently support unsustainable practices. Analysts have identified cases where EV battery recycling programs receive insufficient support compared to primary production incentives. This imbalance could create future environmental challenges as first-generation EV batteries reach end-of-life.

Recent policy adjustments show increasing emphasis on circular economy principles, with subsidies now contingent on meeting specific environmental benchmarks throughout product lifecycles.

Potential for Overcapacity and Market Distortion

Subsidy-driven expansion carries inherent risks of market imbalance. The solar panel industry's experience demonstrates how rapid capacity growth can lead to global price collapses when subsidies create production surges exceeding demand. EV manufacturers currently face similar challenges, with some provincial governments offering overlapping incentives that may distort investment decisions.

Market regulators now employ more sophisticated monitoring tools, including real-time production tracking and demand forecasting, to prevent severe imbalances before they occur.

Global Implications and International Relations

China's subsidy policies increasingly influence global trade negotiations. The EU's recent anti-subsidy investigations into Chinese EVs highlight growing tensions around state-supported industries. These disputes often center on differing interpretations of WTO rules regarding developing nation status and allowable support measures.

Economic diplomats emphasize the need for multilateral frameworks that recognize legitimate development goals while preventing destructive trade practices. The ongoing EV subsidy discussions may establish important precedents for future industrial policy conflicts.

The Future of EV Subsidies and China's Role in the Global Market

The Evolving Landscape of EV Subsidies

National governments face complex decisions regarding EV incentive structures. Some European nations have begun shifting from direct purchase subsidies to infrastructure investments and usage incentives. This transition reflects changing priorities as EV adoption reaches critical mass in certain markets. Policy makers must balance short-term adoption goals with long-term market sustainability considerations.

Emerging battery technologies may further complicate subsidy decisions. Solid-state battery development, for instance, could dramatically alter production cost structures, potentially making current subsidy models obsolete within this decade.

China's Dominance in EV Battery Production

Chinese firms currently control approximately 70% of global lithium-ion battery production capacity. This manufacturing supremacy stems from vertical integration strategies that secure raw material supplies while optimizing production efficiency. CATL and BYD have become benchmark setters for both performance metrics and production costs, forcing global competitors to radically rethink their strategies.

The Impact of Subsidy Reductions on Chinese EV Manufacturers

Beijing's gradual subsidy phase-out program has already reshaped the domestic EV landscape. Smaller manufacturers relying heavily on subsidies have consolidated or exited the market, while industry leaders have strengthened their positions through technological differentiation. This market Darwinism may ultimately produce more globally competitive Chinese automakers, though the transition period creates significant challenges for supply chain partners.

China's Influence on Global EV Standards

Chinese technical standards for fast-charging protocols and battery safety testing are gaining international traction. The GB/T charging standard, while initially developed for domestic use, now influences charging infrastructure development across Southeast Asia and parts of Africa. This standards leadership complements China's manufacturing dominance, creating a self-reinforcing cycle of influence in global EV development.

Geopolitical Implications of EV Subsidy Policies

The US Inflation Reduction Act's local content requirements represent a direct response to Chinese subsidy practices. These competing policy frameworks are creating distinct regional EV ecosystems, with automakers increasingly forced to choose between markets or bear duplicate development costs. Trade analysts predict this bifurcation will accelerate through 2025, potentially leading to separate technological development paths in Western and Chinese-led markets.

The Role of China in Setting Global EV Pricing

Chinese battery cost advantages continue to pressure global automakers' profitability models. Recent analysis suggests Chinese firms maintain a 20-25% cost advantage in battery pack production, a gap that persists despite competitors' efforts to catch up. This pricing power allows Chinese automakers to undercut rivals in emerging markets while maintaining healthy margins, reshaping global competitive dynamics.

The Future of International Collaboration in EV Development

Despite political tensions, technical cooperation continues in areas like charging interoperability and battery recycling. Industry-led initiatives often progress faster than government-to-government agreements, with multinational automakers serving as bridges between competing national interests. The Global Battery Alliance's work on supply chain transparency demonstrates how private sector leadership can advance shared goals despite complex geopolitical backdrops.

Read more about Analyzing China's EV Subsidy Policy and Its Global Impact

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies