How Affordable EVs Are Driving Mass Adoption

In-Depth Analysis of Electric Vehicle Cost Structure and Market Development Trends

Overview of Core Content

- The battery technology revolution reshapes the cost structure of electric vehicles

- Government's multi-dimensional incentive policies activate the consumer market

- Full lifecycle cost advantages highlight market competitiveness

- Charging network construction enters a new stage of rapid development

- Solid-state battery technology is about to trigger new industry changes

Analysis of Electric Vehicle Cost Competitiveness

Deep Breakdown of Cost Composition

To truly understand the price competitiveness of electric vehicles, it is essential to analyze their core cost elements. According to the latest report from McKinsey, battery costs account for 38% of the total vehicle cost, which explains the chain reaction brought by breakthroughs in battery technology. Of note is the newly released third-generation CTP technology from CATL, which enhances the volume utilization of battery packs to 72%, achieving an energy density of 255Wh/kg, directly driving down the cost per kWh by 15%.

In terms of manufacturing process innovation, Tesla's integrated die-casting technology merges over 70 parts into a single cast, reducing the production cost of the Model Y's rear underbody by 40%. This transformation in production paradigms is reshaping industry rules. As Volkswagen's production chief Schmidt stated: We are experiencing a technological revolution in the automobile manufacturing industry like never before in a century.

The Multiplier Effect of Policy Leverage

Norway's practice has demonstrated the power of policy combinations: exemption from 25% VAT, toll-free usage, and free access to public charging stations have resulted in electric vehicles capturing over 85% of the market share in 2023. This policy design is worth emulating for other countries, particularly the innovative model of combining purchase incentives with optimized usage scenarios.

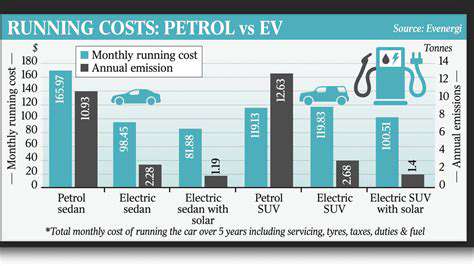

New Perspective on Full-Cycle Cost Comparison

According to the latest research data from J.D. Power, over a five-year usage cycle, the comprehensive costs of mainstream electric vehicle models are 28-35% lower than those of equivalent gasoline vehicles. This difference is more pronounced in areas with well-established charging infrastructure. Taking Beijing as an example, the nighttime electricity price can go as low as 0.3 RMB/kWh, costing only 18 RMB to fully charge a 60 kWh battery, providing a range of 400 km, with energy costs of less than 5 cents per kilometer, which is 1/7th that of gasoline vehicles.

Technology Evolution Roadmap

The commercialization process of solid-state batteries is accelerating: Toyota plans to achieve mass production of all-solid-state batteries by 2025, with energy densities expected to exceed 400Wh/kg and charging times reduced to 10 minutes. This disruptive innovation will completely rewrite the cost equation of electric vehicles. At the same time, the industrialization process of sodium-ion batteries provides new technological options for low-cost models.

Current State of Charging Infrastructure Development

Construction Progress and Model Innovation

China has built the world's largest smart charging network, with public charging piles reaching 2.2 million by the end of 2023, of which fast charging piles account for 45%. Notably, NIO's battery swap station 3.0 can complete battery replacement in just 3 minutes, and this model innovation is changing market perceptions of refueling methods.

Building a Policy Support System

The European Union's newly passed \Alternative Fuel Infrastructure Regulation\ requires member states to have at least one 350kW fast charging station every 60 kilometers of highway by 2025. This legislative guarantee provides certainty for infrastructure development. The $5 billion earmarked for charging networks under the U.S. Inflation Reduction Act is expected to stimulate more than $20 billion in private investment.

Consumer Perception and Environmental Benefits

Key Drivers of Perception Change

According to Deloitte's 2023 Global Automotive Consumer Survey, range anxiety has fallen from being the primary concern in 2019 to fourth place. This shift is due to: 1) average range improvement to 450 km; 2) increased coverage of fast charging networks; 3) lifetime battery warranty services offered by automakers. Innovative educational methods are also vital, such as BYD's electric lifestyle experience camp, which has increased test drive conversion rates by 40%.

Quantitative Analysis of Environmental Benefits

Research from Tsinghua University's School of Environment shows that each electric vehicle can reduce carbon dioxide emissions by 45 tons over its entire lifecycle. If China reaches the goal of 40% penetration rate for new energy vehicles by 2030, it will equate to a reduction in carbon emissions equivalent to one and a half times the total carbon emissions of Beijing each year. This environmental benefit is becoming a driving force for consumer purchases, especially in key cities with PM2.5 exceedances.

Outlook on Future Market Trends

Price Critical Point Prediction

According to Bernstein's consulting model, when battery costs fall to $80/kWh, electric vehicles will reach the price parity tipping point with gasoline vehicles. This critical point may be reached between 2024 and 2025. At that time, the prices of mainstream compact electric cars are expected to drop to the range of 80,000 to 100,000 RMB, genuinely entering the mass consumer market.

New Trends in Technological Integration

The 800V high-voltage platform paired with 4C fast charging technology is becoming a new benchmark: the Xpeng G9 has been tested to increase range by 210 km with just 5 minutes of charging. This speed of technological iteration far exceeds market expectations and is reshaping consumers' value perception system. At the same time, the commercialization of V2G (Vehicle-to-Grid) technology will create new value growth points.