Top EV Insurance Plans and Their Benefits

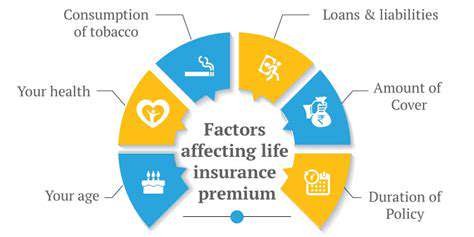

Factors Influencing EV Insurance Premiums

What Determines Your EV Insurance Costs?

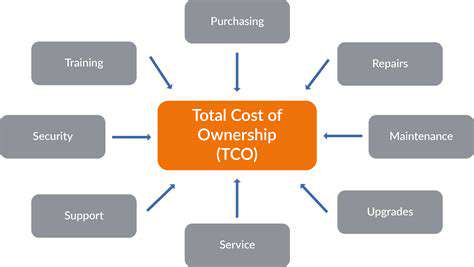

Insuring an electric vehicle involves unique considerations that set it apart from conventional car insurance. These differences stem from the specialized technology and components that make EVs distinct. As more drivers switch to electric, understanding these variables becomes increasingly important for fair pricing.

A major factor is the vehicle's cutting-edge technology package. Most modern EVs come equipped with advanced safety systems like collision avoidance and lane-keeping assist. While these features improve safety, they can paradoxically increase repair costs after accidents due to their complexity.

How Vehicle Value Affects Your Policy

An EV's market value significantly impacts insurance rates, just as with traditional vehicles. Premiums typically scale with the car's purchase price, reflecting the potential financial risk to insurers.

Coverage selection also plays a crucial role. Opting for full comprehensive protection will naturally cost more than basic liability coverage, as it safeguards against a wider range of potential incidents. This tiered pricing structure mirrors standard auto insurance practices.

The Impact of Your Driving Behavior

Many insurers now use telematics to assess risk more accurately. These systems track driving patterns including speed, braking habits, and cornering forces. Safe drivers may qualify for discounted rates through these monitoring programs, creating financial incentives for cautious operation.

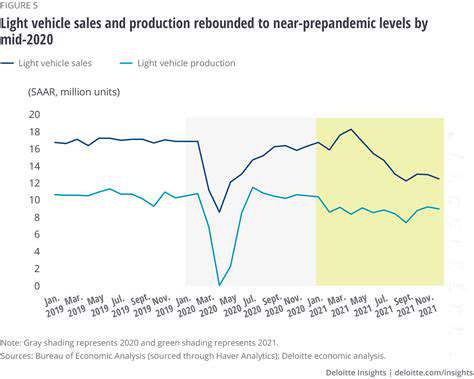

Annual mileage and typical usage patterns also factor into premium calculations. Vehicles used primarily for short urban commutes often receive lower rates than those regularly driven long distances, reflecting differing risk profiles.

Location-Based Insurance Considerations

Where you live and park your EV substantially affects insurance costs. Regions with higher accident rates or extreme weather conditions that challenge electric vehicles typically see elevated premiums.

Local regulations and incentives also play a role. Areas with strong government support for EV adoption sometimes feature more favorable insurance terms, demonstrating how policy decisions can influence market dynamics. These geographic variations highlight the importance of regional factors in insurance pricing.

Creating customized survival equipment offers the advantage of perfect adaptation to specific environmental challenges. Mastering material properties and ergonomic design principles is essential for crafting tools that withstand extreme conditions. Selecting appropriate materials—whether high-grade steel for cutting tools or resilient hardwoods for handles—directly impacts durability and performance. A properly balanced knife, for instance, becomes invaluable for diverse tasks from constructing shelters to processing food.

Specialized Protection for EV Systems

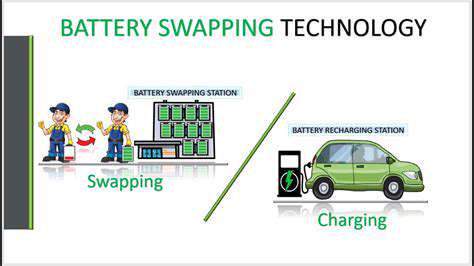

Battery Management Technology

The sophisticated systems monitoring EV battery health require special insurance consideration. These systems continuously track critical metrics like cell temperatures and charge states. Comprehensive policies should account for potential system failures that could necessitate expensive battery replacements. Given the substantial cost of EV battery packs, this coverage proves particularly valuable.

Proper battery management prevents damaging conditions like excessive discharge or thermal overload. Insurance policies should explicitly cover BMS-related failures resulting from accidents or other unexpected events.

Electric Propulsion Systems

As the primary motive force in EVs, electric motors demand specific insurance attention. Coverage should address potential damage to motor assemblies, control units, and associated electrical systems. Protecting against motor failures from impacts or electrical issues forms a critical component of EV-specific policies.

The technical complexity of modern electric drivetrains makes comprehensive coverage essential. Policies should safeguard against various failure modes, from collision damage to power surges.

Charging System Components

EV charging infrastructure represents another specialized coverage area. Insurance should protect against damage to charging ports, cables, and related electronics, whether from accidents, vandalism, or environmental factors. This protection should extend to portable charging equipment vulnerable to damage during use.

Given the importance and vulnerability of charging components, dedicated coverage helps ensure uninterrupted vehicle operation. Policies should address various charging-related failure scenarios.

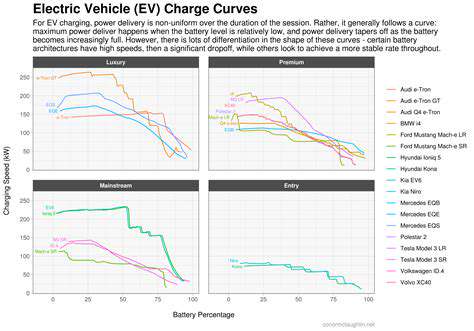

High-Speed Charging Considerations

While DC fast charging enables convenient long-distance travel, its high-power nature introduces unique risks. Insurance should account for potential charging system damage from power fluctuations or equipment malfunctions during rapid charging sessions.

The specialized high-voltage components involved in fast charging require particular insurance attention. Coverage should extend to incidents occurring at public charging stations.

Power Conversion Systems

The electronics managing power flow between battery and motor represent another critical coverage area. Policies should protect against failures in these complex systems that could lead to costly repairs.

Given their sensitivity to electrical issues, power electronics demand robust insurance protection. Comprehensive policies should address various potential failure modes in these vital components.

Read more about Top EV Insurance Plans and Their Benefits

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies