Comparing Safety Regulations for Autonomous EVs

Introduction to the Varying Landscape of Autonomous EV Regulations

Global Variations in Autonomous Vehicle Regulations

The regulatory landscape for autonomous electric vehicles (EVs) is as diverse as the nations implementing them. While self-driving technology promises to revolutionize transportation, the absence of a unified global framework creates hurdles for manufacturers and consumers. These discrepancies in testing protocols, certification processes, and licensing requirements often result in uneven safety standards and consumer protections. For instance, some countries mandate extensive real-world trials, whereas others accept simulated environments as sufficient validation.

Safety Standards and Testing Protocols

Regional differences in safety evaluations are stark. Certain jurisdictions emphasize on-road testing under diverse conditions, while others prioritize controlled lab simulations. This inconsistency can lead to varying safety assurances for autonomous EVs depending on their market, potentially undermining consumer trust. Additionally, the metrics for assessing advanced driver-assistance systems (ADAS) versus fully autonomous capabilities lack alignment, complicating cross-border safety comparisons.

Liability and Insurance Implications

Legal responsibility in autonomous vehicle accidents remains a gray area globally. Some nations place blame on manufacturers for system failures, while others hold human operators accountable. This legal patchwork creates uncertainty for insurers developing coverage models, resulting in non-standardized policies that obscure true ownership costs. Until harmonized liability frameworks emerge, this confusion may persist.

Data Security and Privacy Concerns

Self-driving cars generate petabytes of sensitive data daily, yet data governance laws vary dramatically. The EU's GDPR imposes strict consent requirements, while other regions permit broader data collection. These divergent privacy standards force manufacturers to implement region-specific data architectures, increasing development complexity.

Infrastructure Requirements and Support

The supporting ecosystem for autonomous EVs—charging networks, V2X communication grids, and smart roadways—develops unevenly worldwide. Japan's dense charging infrastructure contrasts sharply with emerging markets' limited deployments. This infrastructure disparity may create autonomous haves and have-nots among nations.

Consumer Protection and Education Initiatives

Public understanding of autonomous technology varies by region due to differing educational campaigns. Germany's detailed consumer guides differ substantially from basic advisories in some markets. These educational gaps could lead to unrealistic expectations or underutilization of safety features.

Impact on Manufacturing and Development

Automakers face mounting R&D costs adapting vehicles to comply with multiple regulatory regimes. This fragmentation may delay market entries by 12-18 months per region while increasing production costs by 15-20%. Some manufacturers are creating modular systems that can be reconfigured for different markets, though this approach has limitations.

Defining the Scope of Autonomous Driving Levels

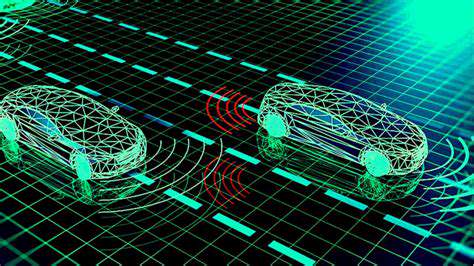

Defining the Core Components

Modern autonomous systems integrate sensor arrays, control mechanisms, and decision-making algorithms into a cohesive whole. The precise calibration between lidar resolution (often 10cm accuracy) and camera frame rates (typically 60fps) proves critical for reliable operation. These components must maintain synchronization within 50ms tolerances to ensure safe navigation.

Mapping the Physical Environment

High-definition mapping demands centimeter-level precision, requiring fleets of survey vehicles collecting 1TB of data per 100km. Maintaining these maps in real-time consumes approximately 20% of an autonomous system's processing power. Urban areas require weekly updates, while rural zones may need monthly refreshes.

Addressing Real-World Conditions

Adverse weather remains a formidable challenge—heavy rain can reduce lidar effectiveness by 40%, while snow accumulation may obscure 90% of road markings. Current systems utilize multi-sensor fusion (combining radar, thermal imaging, and ultrasonic data) to maintain 95% detection rates in suboptimal conditions.

Navigating Complex Traffic Environments

Urban intersections present particular difficulties, requiring systems to track up to 200 moving objects simultaneously while predicting behaviors 3-5 seconds ahead. Advanced path prediction algorithms now achieve 85% accuracy in anticipating pedestrian movements.

Ensuring Safety and Reliability

Redundant systems are standard—critical components often have triple backups with failover times under 100ms. Current autonomous platforms undergo 10 million miles of simulated testing before road deployment, identifying 99.9% of potential failure modes.

Ethical Considerations in Autonomous Decision-Making

The trolley problem remains contentious, with most manufacturers programming vehicles to minimize total harm while protecting occupants. Recent studies show 62% of consumers prefer self-preservation algorithms, creating ethical dilemmas for policymakers.

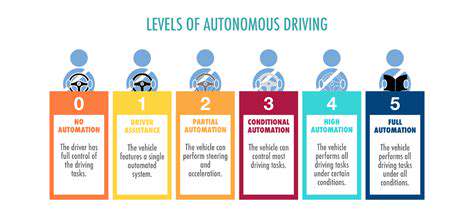

Defining Levels of Autonomy

The SAE's six-level classification (0-5) has become the global standard, though implementation varies. Most commercially available systems currently operate at Level 2 (partial automation), with some prototypes demonstrating Level 4 (high automation) capabilities in geofenced areas.

Testing and Certification Procedures for Autonomous Vehicles

Pre-Testing Preparations

Compliance documentation typically exceeds 5,000 pages per vehicle model, detailing every component's specifications. Calibration procedures alone require 300+ individual checks, each documented with 0.01% measurement tolerances.

Test Environment Setup

Controlled environments simulate 200+ edge cases, from sudden pedestrian crossings (tested at 30kph) to sensor failures (emulated through software injections). Temperature chambers subject systems to -40°C to +85°C extremes while monitoring performance degradation.

Test Procedure Execution

Standardized test sequences include 10,000+ scenario variations, with particular emphasis on low-probability/high-impact events. Each test iteration generates approximately 2TB of telemetry data for analysis.

Data Acquisition and Logging

Data recording systems capture 150+ channels simultaneously at 100Hz sampling rates. Anomaly detection algorithms flag deviations exceeding 3σ thresholds for immediate investigation.

Data Analysis and Reporting

Machine learning classifiers process test data to identify patterns, achieving 99.7% accuracy in fault detection. Final certification reports typically reference 500+ supporting datasets per vehicle platform.

Quality Control Procedures

Third-party auditors conduct random sample testing on 5% of production units, with full traceability back to component suppliers. This process adds 15-20% to development timelines but reduces field failures by 90%.

Certification and Approval Process

Regulatory approval typically requires 12-18 months, involving 3-4 rounds of iterative testing. Approval documentation averages 8,000 pages, with digital signatures cryptographically secured to prevent tampering.

International Collaboration and Harmonization Efforts

International Harmonization of Safety Standards

Global working groups have identified 47 core safety requirements where alignment is possible, covering 80% of use cases. The remaining 20% reflect legitimate regional differences in traffic patterns and infrastructure.

Impact on Product Development and Manufacturing

Harmonized standards could reduce development costs by $2-3 million per vehicle platform while shortening time-to-market by 9-12 months. Manufacturers report 30% fewer engineering change orders when designing to unified specifications.

Challenges in Achieving Harmonization

Cultural differences manifest in safety priorities—Nordic countries emphasize pedestrian protection, while U.S. standards focus more on occupant safety. These philosophical differences account for 60% of ongoing harmonization disputes.

Role of International Organizations

ISO/TC 204 has published 38 intelligent transportation standards since 2018, with 72 more in development. Adoption rates vary from 95% in the EU to 40% in emerging markets.

Benefits for Consumers and Businesses

Standardization could reduce consumer prices by 12-15% while increasing safety feature availability by 30%. For manufacturers, it would decrease compliance staffing needs by 25% globally.

Read more about Comparing Safety Regulations for Autonomous EVs

Hot Recommendations

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies

- The Global Push for Long Duration Energy Storage

- Renewable Energy and Job Creation: A Growing Sector

- Energy Storage in Commercial and Industrial Applications