Power Purchase Agreements (PPAs) in Corporate Renewable Procurement Explained

Negotiating and Structuring a Successful PPA

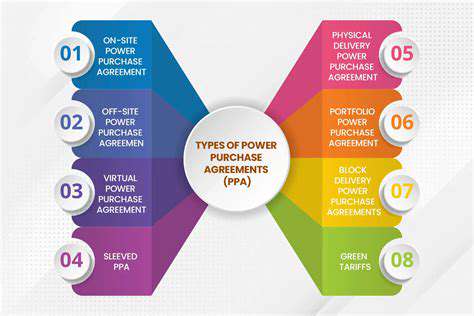

Understanding the Fundamentals of PPAs

Power Purchase Agreements (PPAs) are legally binding contracts that outline the terms and conditions for the purchase of electricity from a renewable energy source, typically a solar or wind farm. These agreements are crucial for both the buyer and seller, establishing clear expectations regarding pricing, energy delivery, and maintenance responsibilities. Understanding the fundamental principles of a PPA is essential for both parties to achieve a mutually beneficial outcome.

The core of a PPA lies in defining the long-term energy needs of the buyer and the capacity of the seller to meet those needs. This includes factors like the amount of electricity to be purchased, the duration of the agreement, and the rate at which energy will be delivered. Properly understanding these fundamentals is crucial for mitigating risk and ensuring a successful transaction.

Defining the Scope of the Project

A critical aspect of negotiating a successful PPA is clearly defining the scope of the project. This involves outlining the specific location of the renewable energy facility, the anticipated energy output, and the technical specifications of the equipment. A precise understanding of the project's scope ensures that both parties are aligned on the expected performance and reduces the potential for future disputes.

Thorough due diligence on the project's technical aspects is essential. This includes analyzing the environmental impact, assessing the financial viability, and verifying the regulatory compliance of the proposed renewable energy project. A well-defined scope minimizes uncertainty and strengthens the reliability of the agreement.

Negotiating Competitive Pricing Models

Pricing models are a significant component of PPA negotiations. Different models exist, each with its own advantages and disadvantages. Understanding these options, such as fixed-price, index-based, or tiered pricing, is vital for determining the most suitable approach for both parties. Careful consideration of market conditions and future energy costs is necessary for setting a fair and competitive price.

Addressing Risk Management Strategies

Risk management is paramount in any PPA. Potential risks include fluctuations in energy prices, changes in government regulations, and technical failures. Developing strategies to mitigate these risks is crucial for safeguarding the interests of both the buyer and the seller. These strategies can include contingency plans, insurance provisions, and clear dispute resolution mechanisms.

Ensuring Regulatory Compliance

Navigating the regulatory landscape is essential for a successful PPA. Understanding and complying with all applicable environmental, energy, and financial regulations is critical. This includes obtaining necessary permits, licenses, and approvals. Both parties should conduct thorough due diligence to ensure compliance throughout the agreement's lifecycle.

Structuring Payment Mechanisms

Payment mechanisms play a vital role in the financial structure of a PPA. The agreement must clearly define the terms of payment, including the frequency of payments, the method of payment, and any penalties for late or missed payments. A robust payment structure ensures financial stability and predictability for both parties. This also includes consideration of any potential tax implications.

Establishing Dispute Resolution Procedures

Disagreements may arise during the life of a PPA. Establishing clear and effective dispute resolution procedures is crucial for managing these situations. This may include mediation, arbitration, or other legal avenues. Having pre-defined procedures reduces the likelihood of protracted legal battles and helps maintain a positive working relationship.

Read more about Power Purchase Agreements (PPAs) in Corporate Renewable Procurement Explained

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies