How Regulatory Changes Influence EV Insurance Policies

Regulatory Pressure for EV Insurance Policy Reforms

Insurance Coverage for Electric Vehicle (EV) Accidents

The rapid rise of electric vehicles (EVs) has forced insurance providers to rethink their coverage strategies. Unlike conventional cars, EVs come with high-voltage battery systems that demand specialized repairs, often at greater expense. This technological shift compels insurers to develop tailored policies that properly protect drivers while preventing drawn-out claim disputes.

Battery-related fire risks present another critical consideration. Current policies must evolve to include explicit protocols for handling such incidents, covering not just vehicle damage but also potential environmental hazards. The insurance industry faces mounting pressure to create comprehensive protections addressing EV-specific dangers.

Impact of EV Battery Technology on Repair Costs

Modern EV batteries, integrated into vehicle frames, prove far more complex to repair than traditional engines. These sophisticated systems frequently lead to higher claim costs and longer repair timelines. Insurers must carefully evaluate these factors when setting coverage limits to balance financial protection for both themselves and policyholders.

The shortage of qualified EV technicians further complicates matters. Limited availability of specialists can significantly delay repairs, a factor insurers must account for in their policy terms. Proper coverage should address these extended downtime periods and their financial consequences.

Liability and Responsibility in EV Accidents

Assigning fault in EV collisions involves unique complexities. Battery systems and advanced safety features introduce variables rarely seen in conventional vehicle accidents. Insurers need specialized investigation procedures that consider potential manufacturing defects or system failures that might contribute to incidents.

Advanced driver assistance systems, common in EVs, create new liability considerations. Policy language must precisely address these technologies to ensure fair fault determination and prevent unnecessary claim disputes. This requires deep understanding of EV engineering and potential failure scenarios.

Regulatory Landscape and Policy Requirements

Global governments are actively shaping EV insurance standards through new regulations. These rules frequently target EV-specific risks, forcing insurers to modify their offerings. Compliance has become critical, with regulatory bodies demanding adherence to evolving frameworks that address battery fires, component failures, and specialized repairs.

The insurance sector must adapt quickly to these changing requirements while maintaining financial viability. Balancing comprehensive coverage with sustainable pricing models represents a significant challenge in this rapidly evolving market.

Consumer Awareness and Education on EV Insurance

Growing EV adoption highlights the need for better consumer education about insurance specifics. Policyholders require clear information about potentially higher repair costs and the importance of specialized coverage. Insurers should prioritize transparent communication, avoiding industry jargon in policy documents.

Accessible resources like detailed FAQs and dedicated support channels can empower consumers to make informed choices. Transparency about coverage limitations proves equally important as explaining protections.

Ensuring Adequate Coverage for EV-Specific Risks

Ensuring a Smooth Transition to Electric Vehicles

The shift toward electric vehicles brings both opportunities and challenges. Beyond charging infrastructure, it demands robust support networks capable of handling EV-specific maintenance needs. Strategic infrastructure planning remains essential to prevent service gaps and ensure equitable access to EV technology across communities.

Public education campaigns must address common concerns like range anxiety while highlighting environmental benefits. Such initiatives can accelerate adoption by building consumer confidence in EV technology.

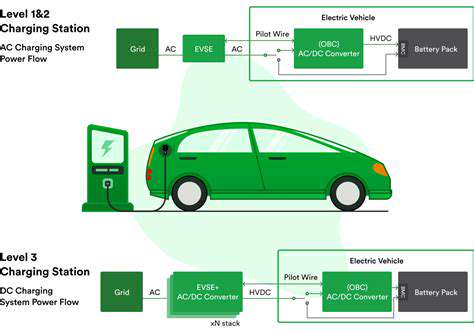

Addressing Charging Infrastructure Needs

Widespread EV adoption hinges on accessible, affordable charging solutions. Strategic placement of public stations combined with residential and commercial charging options will determine market success. Standardized charging protocols across networks remain crucial for seamless user experiences.

This standardization not only simplifies charging but also facilitates EV integration into existing transportation systems, removing a significant barrier to broader adoption.

Supporting EV Maintenance and Repair

A sustainable EV market requires skilled technicians and specialized repair facilities. Developing this workforce and ensuring parts availability will prove critical for addressing breakdowns promptly. Timely, competent repairs remain vital for maintaining consumer confidence in EV technology.

Responsible battery recycling programs also demand attention. Proper end-of-life management for EV components ensures the technology delivers on its environmental promises long-term. This circular approach sustains EVs' ecological advantages beyond their operational lifespan.

The Future of EV Insurance in a Dynamic Regulatory Environment

Navigating the Evolving Landscape of EV Insurance Regulations

The growing EV market creates complex challenges for insurers navigating shifting regulations. Governments worldwide are developing standards addressing battery warranties, specialized repairs, and comprehensive coverage needs. Staying current with these changes helps insurers and policyholders avoid coverage gaps.

Standardized repair procedures are emerging as a key focus area. Certified technicians and uniform practices will improve repair quality while potentially reducing insurance costs for compliant policyholders.

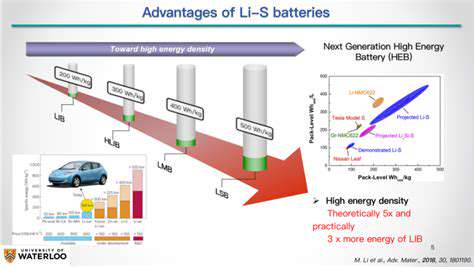

The Impact of Battery Technology on EV Insurance Models

Lithium-ion batteries introduce unique insurance considerations, from degradation patterns to fire risks. Insurers must account for these factors while anticipating technological advancements that may alter repair costs. Proactive measures like battery-specific coverage and manufacturer collaborations can mitigate financial risks.

Given the high cost of battery replacements, insurers need innovative approaches to maintain affordability while providing adequate protection. These adaptations will prove crucial as battery technology continues evolving.

Insurance Premiums and Consumer Perception in the EV Era

Consumer attitudes significantly influence EV insurance development. While initial premiums may be higher due to perceived risks, accumulated data and regulatory clarity should lead to more competitive pricing. Clear communication about coverage details builds essential trust with policyholders.

Transparency regarding battery-related protections remains particularly important. As the market matures, insurers must balance comprehensive coverage with affordability to support continued EV adoption.

Read more about How Regulatory Changes Influence EV Insurance Policies

Hot Recommendations

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies

- The Global Push for Long Duration Energy Storage

- Renewable Energy and Job Creation: A Growing Sector

- Energy Storage in Commercial and Industrial Applications

- Direct Air Capture (DAC) Powered by Renewable Energy