Corporate Renewable Energy: Enhancing Brand Value and Corporate Reputation

Beyond Brand Enhancement: Exploring the Financial Implications

Brand enhancement is crucial for long-term success, but companies must also consider the financial implications of their strategies. A strong brand can attract investors and build customer loyalty, leading to increased revenue and profitability. However, brand building initiatives require significant financial investment, and companies need to carefully assess the return on investment (ROI) to ensure these strategies are financially sound.

Understanding the financial metrics associated with brand building activities, such as marketing campaigns, public relations efforts, and product development, is essential for making informed business decisions. Careful budgeting and forecasting are key to maximizing the financial impact of brand enhancement initiatives and avoiding potential financial pitfalls.

Financial Projections and Brand Strategy Alignment

Accurate financial projections are vital for aligning brand strategy with financial goals. Detailed financial models should incorporate the anticipated costs and revenues associated with different brand-building activities. This allows companies to assess the potential return on investment (ROI) of various strategies and make informed decisions about resource allocation.

By closely linking brand strategy to financial projections, companies can ensure that their brand-building initiatives contribute directly to achieving their overall financial objectives. This alignment fosters a more strategic and sustainable approach to brand management.

Risk Management and Financial Stability

Brand building initiatives can involve significant financial risks, from unexpected market fluctuations to unforeseen challenges in executing planned strategies. Thorough risk assessment is crucial to mitigate these risks and maintain financial stability.

Companies should develop contingency plans to address potential issues that might negatively impact their financial performance, such as changes in consumer preferences or economic downturns. Effective risk management strategies provide a safety net, ensuring that brand-building efforts do not jeopardize the company's financial well-being.

Measuring ROI and Assessing Brand Equity

Measuring the return on investment (ROI) of brand-building initiatives is critical for demonstrating their value to stakeholders. Different metrics can be used to assess the impact of branding on financial performance, such as increased sales, customer acquisition costs, and brand valuation.

A strong brand contributes to brand equity, which can be reflected in higher pricing power and stronger customer relationships. Accurate measurement of brand equity allows companies to understand the long-term financial value of their brand and make informed decisions about future investments.

Funding Brand-Building Initiatives: Strategies for Success

Securing adequate funding for brand-building initiatives is often a significant challenge. Companies need to explore various financing options, including venture capital, debt financing, and internal capital allocation, to support their brand-building strategies.

Careful financial planning and a well-defined budget are essential for securing funding and ensuring that the allocated resources are used effectively to achieve the desired brand-building objectives. Strategic partnerships and collaborations can also provide access to additional resources and expertise.

Brand Valuation and Financial Performance

Brand valuation is a crucial element in understanding the financial impact of brand-building efforts. A well-defined brand valuation framework can help companies assess the overall financial worth of their brand and identify areas for improvement.

Strong brands often command higher valuations, indicating a positive correlation between brand strength and financial performance. Regular brand valuation assessments help companies track the evolution of their brand equity and make informed decisions about future investments in brand-building activities.

Read more about Corporate Renewable Energy: Enhancing Brand Value and Corporate Reputation

Hot Recommendations

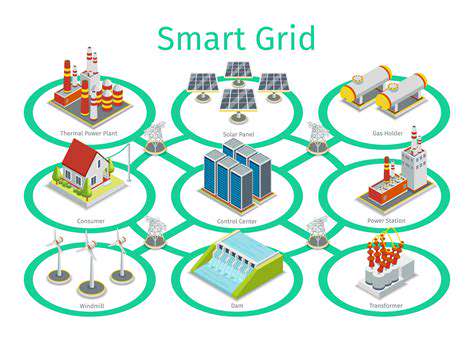

- How Your Rooftop Solar Contributes to the Grid

- Solar Energy for Electric Vehicle Charging Stations

- Offshore Wind Repowering

- Agricultural Solar (Agrivoltaics): Synergies Between Food and Energy

- Airborne Wind Energy: Tapping High Altitude Winds

- Renewable Energy and Green Hydrogen: A Powerful Duo

- Geothermal Power Plant Technologies: Flash, Dry Steam, and Binary Cycle

- The Future of Offshore Wind Transmission

- The Role of Energy Storage in Enhancing Energy Security

- The Environmental Footprint of Modern Wind Energy Advancements: LCA Analysis