The Role of Energy Storage in Enhancing Energy Security

Energy Storage: Bridging the Gap in Renewable Energy

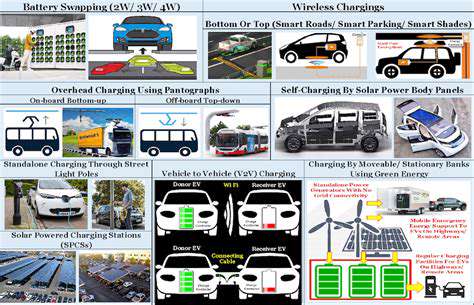

The increasing reliance on renewable energy sources like solar and wind presents a significant challenge: their intermittent nature. Solar panels generate electricity only when the sun shines, and wind turbines produce power only when the wind blows. This variability necessitates a robust energy storage solution to ensure a consistent and reliable power supply, crucial for maintaining grid stability and enabling widespread adoption of renewables.

Energy storage systems are vital in smoothing out these fluctuations. They act as buffers, absorbing excess energy generated during peak production periods and releasing it when demand is high or renewable generation is low. This ability to manage the intermittency of renewables is fundamental to the integration of these crucial technologies into modern power grids.

Enhanced Grid Stability and Reliability

Energy storage systems play a critical role in enhancing the overall stability and reliability of power grids. By providing a dynamic response to fluctuations in energy supply and demand, they mitigate the risk of grid collapse during periods of high stress. This is especially important in geographically dispersed energy systems where reliance on renewable sources is high, and localized power outages can quickly cascade into broader disruptions.

Moreover, energy storage can help maintain voltage and frequency stability, preventing unwanted oscillations and ensuring the smooth operation of connected devices and equipment. This enhanced stability translates to a more resilient and reliable power grid, reducing the likelihood of outages and ensuring consistent power delivery to consumers.

Economic Benefits and Cost Reduction

The integration of energy storage technologies brings about a multitude of economic benefits. By reducing the need for expensive and inflexible peaking power plants, energy storage systems can lead to significant cost savings in the long run. This reduced reliance on fossil fuel-based power generation not only lowers operational costs but also contributes to a cleaner and more sustainable energy future.

Furthermore, the ability of energy storage to optimize the use of renewable energy resources can lead to lower electricity costs for consumers. By enabling grid operators to better manage energy flow and balance supply and demand, energy storage solutions contribute to a more efficient and cost-effective energy system.

Technological Advancements and Future Implications

Rapid advancements in energy storage technology are paving the way for more efficient and cost-effective solutions. From lithium-ion batteries to pumped hydro storage and emerging technologies like flow batteries, the variety of options available is expanding, offering diverse solutions tailored to specific applications and requirements.

The continued development of these technologies holds immense promise for future energy systems. As storage systems become more efficient and affordable, their adoption will accelerate, leading to a more decentralized and sustainable energy landscape. This will enable a greater integration of renewable energy sources, fostering a cleaner and more resilient energy future for all.

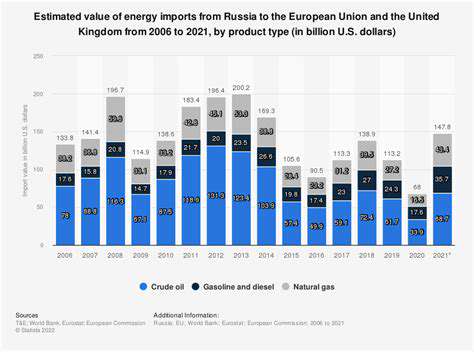

Diversification and Reduced Reliance on Imports

Diversification Strategies

Diversification is a crucial aspect of risk management in any business or investment portfolio. It involves spreading resources across a variety of different areas to reduce the impact of negative events within a single sector or market. By reducing reliance on a single product, service, or market, companies can mitigate potential losses and increase their resilience to external shocks. This can include expanding into new markets, developing new product lines, or forging strategic partnerships.

Different diversification strategies exist, each with its own set of advantages and disadvantages. For example, horizontal diversification focuses on expanding into related markets, while vertical diversification involves expanding into different stages of the supply chain. Careful consideration of market dynamics and competitive landscapes is essential to developing an effective diversification strategy that aligns with long-term goals.

Reduced Reliance on Single Factors

A key benefit of diversification is the reduction of reliance on a single factor, be it a specific market segment, a single product, or a limited customer base. This strategy significantly minimizes the risk associated with adverse events impacting a particular area of operation. A diversified approach ensures that a downturn in one area doesn't cripple the entire enterprise, allowing for a more stable and predictable performance over time.

Reduced reliance on a single factor is also vital for maintaining a steady flow of revenue. Diversification creates multiple revenue streams, which can offset potential losses in one area. This resilience is particularly important in volatile economic environments where market conditions can change rapidly.

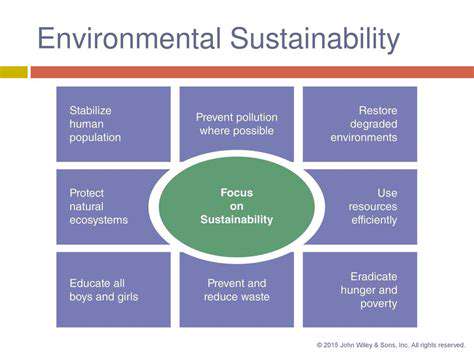

Long-Term Sustainability

Diversification fosters long-term sustainability by reducing dependence on short-term trends or specific market conditions. By spreading investments and resources across various sectors, companies can mitigate the impact of market fluctuations and economic downturns, ensuring a more stable financial future. This strategic approach is essential for organizations aiming for long-term growth and stability.

Furthermore, diversification can enhance the overall financial stability of an organization by creating a more robust and resilient structure. This helps to insulate the company from unforeseen shocks and challenges, enabling it to adapt to changing market conditions more effectively.

Risk Mitigation and Performance

Diversification plays a pivotal role in mitigating risks, enhancing financial performance, and fostering resilience. By diversifying investments and operations, organizations can significantly reduce their vulnerability to external shocks and market volatility. This strategic approach can lead to more consistent and predictable financial performance.

Diversified portfolios or businesses often exhibit more stable returns, providing a buffer against potential losses in specific areas. This enhanced stability is particularly beneficial in uncertain economic environments where market conditions can shift rapidly. Ultimately, diversification is a fundamental aspect of a sound risk management strategy.

Read more about The Role of Energy Storage in Enhancing Energy Security

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies