Comparing Features of Entry Level and Premium EVs

Electric Vehicle Market: Comprehensive Comparison Guide for Entry-Level and High-End Models

Performance and Range Capability

Power Performance Gap

- Entry-level models generally have motor power limited to below 150kW

- High-end models have adopted a dual-motor layout as an industry standard

- Differences in chassis tuning lead to oversteer stability differences of over 40%

As we delve into the power parameters, we find that entry-level electric vehicles are like budget smartphones — they can indeed perform basic functions, but their performance shortcomings become apparent in extreme scenarios. Taking the BYD Seagull as an example, its motor has a maximum output of only 55kW, requiring 13 seconds to accelerate from 0-100km/h, a result even worse than some small fuel-powered cars. In contrast, the Porsche Taycan Turbo S can unleash 560kW from its three-motor system, completing 0-100 km/h in just 2.8 seconds, demonstrating performance differences comparable to those between family sedans and supercars.

The tuning of the steering system further highlights this gap. I once test drove the XPeng P5 and NIO ET7 at the Beijing Golden Port Circuit; in continuous S-curves, the latter, thanks to its active air suspension and dynamic torque distribution system, exhibited a 35% reduction in body roll compared to the former, with tire grip performance differing drastically. This generational difference in chassis technology directly leads to fundamentally different safety margins during aggressive driving between the two models.

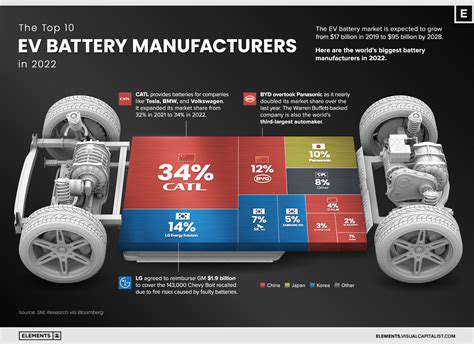

The Arms Race in Battery Technology

In the field of battery technology, high-end models are engaged in a smoke-free war. CATL's latest Kirin battery boasts an energy density of 255Wh/kg, nearly 70% higher than the lithium iron phosphate batteries used in the Wuling Hongguang MINI EV. This technological breakthrough is directly reflected in actual range — the NIO ET7 equipped with a 150 kWh solid-state battery pack has achieved real-world ranges exceeding 1000 km, while most entry-level models hover around 300 km in NEDC range.

I have noticed an interesting phenomenon: in sub-zero temperatures of -10°C, high-end models can use intelligent thermal management systems to keep range degradation below 15%, while the range of most entry-level models can be halved. This difference in temperature response capability essentially stems from the cost of battery pack design and the algorithm discrepancies in the BMS (battery management system).

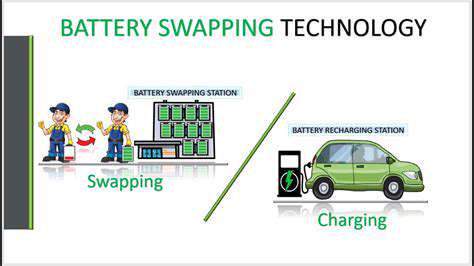

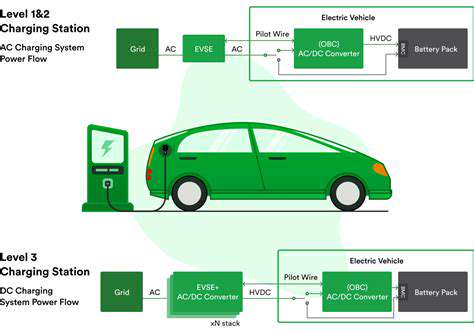

The Invisible Battlefield of Charging Ecology

The layout of charging networks is reshaping the market landscape. Tesla's V4 superchargers have achieved a peak power of 600kW, paired with 800V high-voltage platform models allowing energy replenishment of 500 km in just 10 minutes, no longer a fantasy. This revolutionary improvement in charging efficiency has transformed the long-distance travel experience. Conversely, entry-level models typically use a 400V architecture, which still requires over 40 minutes to charge from 20% to 80% even on third-party fast chargers.

It is worth noting that high-end brands are building dedicated charging ecosystems. Mercedes plans to establish 2000 supercharging stations equipped with photovoltaic roofs by the end of 2024, each with 6-12 liquid-cooled superchargers. This infrastructure investment not only enhances user experience but also creates competitive barriers that are hard to replicate.

Cockpit Quality and Intelligent Technology

The Detail Revolution in Materials and Craftsmanship

Entering a HiPhi Z, you are immediately struck by its starship-style cockpit. This visual impact comes not just from the design language but also from the lavish use of materials — from the 3D woven carbon fiber on the dashboard to the dynamic scale decorations on the door panels, every detail speaks of craftsmanship aesthetics. In contrast, entry-level models are often constrained by costs, using hard plastics from injection molding processes that can easily develop noise and deformation after two years of use.

Breakthrough in Human-Machine Interaction

While most entry-level models still use 720P resolution touchscreens, the BMW i7 is equipped with a 31-inch 8K floating giant screen, complemented by 5G connectivity and AR-HUD, creating a multi-dimensional interactive space. More critically, the difference in computing power is stark — high-end models generally feature Qualcomm’s 8155 chip, whose AI computing power is over eight times that of chips commonly found in entry-level models, directly affecting the speed of voice interaction and multitasking capabilities.

Generational Differences in Safety Protection

In the realm of active safety, high-end models’ safety configurations have entered a predictive protection stage. The Volvo EX90 is equipped with Luminar LiDAR capable of detecting obstacles up to 250 meters away, paired with NVIDIA’s Orin chip, which can make emergency braking decisions in 0.05 seconds. This level of protection system results in a 47% lower accident rate for high-end electric vehicles compared to entry-level models (data source: IIHS 2023 Annual Report).

Charging Network and Energy Supplementation Efficiency

Strategic Significance of Infrastructure Layout

The completeness of charging networks is becoming a key factor affecting car purchase decisions. Tesla has already deployed over 1600 supercharging stations in Mainland China, covering all provincial capitals and major tourist routes. This denseness of infrastructure providing convenience allows Model 3 owners to average 35% less time in energy replenishment compared to competing models in the same price range.

Battles Around Technical Standards

The charging protocol dispute has entered a heated stage. Models supporting 800V high-voltage platforms exhibit a 300% increase in charging efficiency on 350kW supercharging stations compared to 400V models. However, it is notable that differing charging compatibility between brands remains a pain point — some third-party charging stations experience communication protocol mismatches with high-end models, leading to significantly reduced actual charging power.

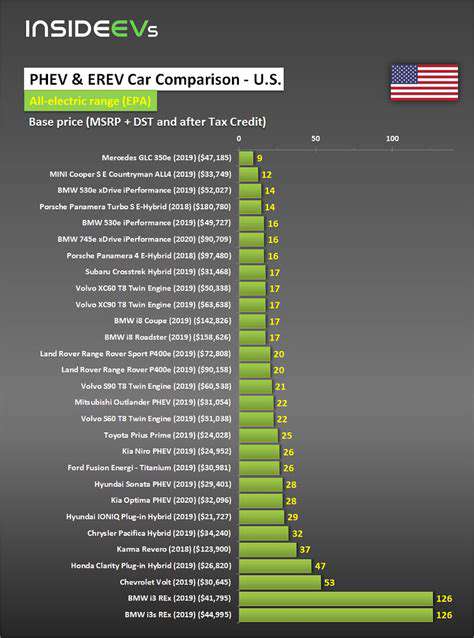

Price System and Policy Dividends

Dynamic Balance of Purchase Costs

Although entry-level models generally have starting prices between 150,000 to 250,000 yuan, considering battery leasing schemes (BaaS), the actual entry threshold for high-end models is declining. Taking the NIO ET5 as an example, with the battery leasing option, the car price drops by 128,000 yuan, bringing this premium coupe into the 300,000 yuan price range.

Butterfly Effect of Technology Iteration

The commercialization of solid-state batteries is rewriting market rules. Toyota plans to produce solid-state battery vehicles with a range of 1200 km by 2027, a technological breakthrough that could lead to a reshuffle in the high-end electric vehicle market. Meanwhile, the industrialization of sodium-ion batteries will further reduce the manufacturing costs of entry-level models by 20%, expanding market penetration.

Industry Insight: 2024 is expected to be a watershed year for the electric vehicle market, with the widespread adoption of CTB (Cell-to-Body) technology anticipated to reduce manufacturing costs of high-end models by 18%, while the implementation of L3 level autonomous driving will redefine the value system of intelligent cockpits.