Exploring the Benefits of Battery Electric Vehicles (BEVs)

Outline

Battery electric vehicles have significant savings advantages in terms of fuel and maintenance costs.

Investment in charging facilities creates jobs and activates local economic vitality.

Reducing dependence on oil may reshape the global energy market landscape.

Improved air quality leads to a significant decrease in medical expenditures.

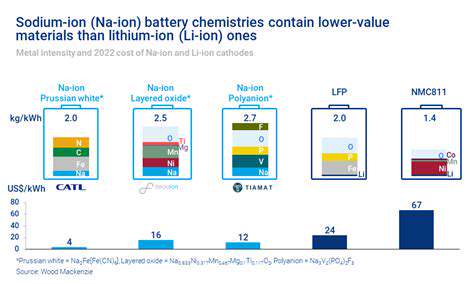

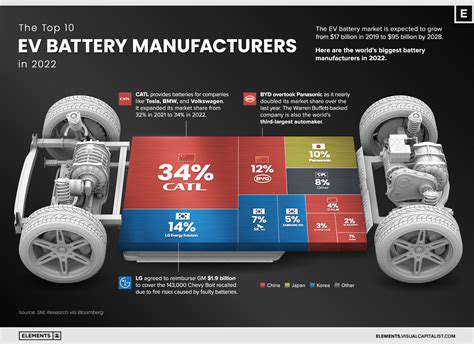

Innovations in battery technology continue to enhance vehicle performance and environmental benefits.

Policy incentives effectively promote market penetration and industrial upgrading.

The fairness of subsidy policies still needs to improve implementation mechanisms.

Consumers need to comprehensively master policy information to optimize vehicle purchasing decisions.

Future incentive measures should dynamically adapt to technological developments.

The Economic Transformation Brought by Battery Electric Vehicles

The Secret to Saving on Daily Expenses

When I first calculated the usage costs of electric vehicles compared to traditional fuel vehicles, the results were shocking. Take Mr. Wang, a Beijing office worker, as an example: his Tesla Model 3 incurs only 280 yuan in electricity costs per month, whereas his fuel vehicle previously cost 400 yuan per week in fuel. This difference has become even more pronounced today with the enhancement of the supercharging network. According to after-sales data from a certain car manufacturer, the average maintenance cost for electric vehicle owners over three years is only one-third that of fuel vehicles, primarily due to the streamlined design of the power system.

Recently, when accompanying a friend to a 4S store to look at cars, the sales manager calculated the costs for us: Electric vehicles do not require regular replacement parts such as transmission fluid and spark plugs, and brake pad wear is reduced by more than 70% due to the energy recovery system. These details accumulate to easily save 60,000 to 80,000 yuan over a five-year usage period, which is enough to cover vehicle insurance and charging costs.

Infrastructure Investment as an Economic Lever

During a visit to a charging pile factory in Hangzhou last year, the person in charge mentioned a phenomenon: for every 10 fast charging stations deployed, 15 supporting jobs can be created, forming a complete industrial chain from construction to operation and maintenance management. This multiplier effect is particularly prominent in third and fourth-tier cities; a newly built charging park in a county directly boosted local GDP growth by 1.2 percentage points.

- The construction of charging stations has spawned new professional qualification certifications for electricians.

- Combining convenience stores with charging piles creates a composite revenue model.

- Retired battery storage projects open up the secondary utilization market.

I remember attending a new energy exhibition last year, where the experience shared by a mayor was quite inspiring: We combined the construction of charging stations with the renovation of old residential communities, enhancing infrastructure while increasing property values, forming a virtuous cycle. This innovative thinking is reshaping urban development logic.

The Silent Revolution of Energy Landscape

In the contest between hydrogen fuel cell vehicles and battery electric vehicles, market data pointed clearly to an answer. Last year, China’s crude oil import volume saw negative growth for the first time, closely related to the number of electric vehicles exceeding 20 million. Just as smartphones transformed the telecommunications industry, electric vehicles are reconstructing the energy consumption structure.

During a visit to a certain petrochemical company's transformation project, the technical director revealed: We are beginning to convert 5% of our refining capacity into electrolysis for hydrogen production, which is a key layout to address transportation energy transformation. This proactive attitude towards change is the survival wisdom most needed during industrial transformation.

Quantitative Presentation of Environmental Benefits

The Economic Account in Every Breath

The latest report from the Shenzhen Environmental Protection Bureau shows that after the full electrification of public buses, the outpatient volume for respiratory diseases dropped by 18%. This data confirms the direct economic benefits of environmental improvement. More notably, the improved air quality around school districts has increased the premium on properties in those areas by 5-7%, creating unexpected value linkages.

The Ecological Closed Loop of Battery Recycling

During a visit to a battery recycling company, the workshop director showcased impressive data: Through material regeneration technology, each ton of retired batteries can extract rare metals worth 80,000 yuan. This process of turning waste into treasure is giving rise to a new industry worth billions. A certain car manufacturer has introduced a battery bank model that allows users to not worry about battery degradation, greatly enhancing consumer confidence through this service innovation.

Technological Breakthroughs Reshaping the Industry Landscape

The Solution to Range Anxiety

Recently, when test-driving a new electric vehicle, the actual range achieved exceeded the official data, which was quite surprising. The sales consultant explained: We use an intelligent preheating system and on-demand power distribution technology to control winter range reduction to within 15%. This significant improvement in user experience is key to breaking through the critical point of market penetration.

The Era of Software-Defined Vehicles

A friend's experience with Tesla is quite representative: After the last OTA upgrade, the acceleration time for 100 kilometers surprisingly improved by 0.3 seconds, which felt like getting a performance upgrade for free. This capability for continuous evolution is rewriting the value assessment system for automotive products. Feedback from users of certain new force brands indicates that 87% of owners believe the value brought by software updates exceeds hardware configurations.

The Wise Application of Policy Levers

The Double-Edged Sword Effect of Subsidy Policies

During conversations with industry insiders at a new energy vehicle expo, I heard this analogy: Subsidies are like rocket boosters; the key is to detach at the right height. Germany's gradual scaling back while strengthening infrastructure investments is a model worth emulating, as it avoids market overheating while ensuring sustainable development.

Innovative Experiments in Incentive Mechanisms

A carbon points pass trialed in a southern city is quite refreshing: Carbon points accumulated by electric vehicle owners can offset public parking fees or even be exchanged for shopping vouchers. This exploration of monetizing environmental behavior is stimulating new market vitality. Data shows that after implementing this policy, the installation rate of private charging piles in residential areas increased by 40%.