Green Hydrogen for Corporate Decarbonization: A Future Pathway

Investment Strategies for the Future

The future is a complex tapestry woven from interconnected threads of technological advancement, evolving consumer preferences, and global geopolitical shifts. Navigating this landscape requires a nuanced understanding of market trends and a proactive approach to investment strategies. Successful investors will need to adapt to these changes, anticipating emerging opportunities and mitigating potential risks. This involves a deep dive into sectors poised for growth, from renewable energy to artificial intelligence, and a strategic allocation of capital across various asset classes.

It's crucial to remember that there's no one-size-fits-all approach. Diversification is key, ensuring a portfolio that's resilient to market fluctuations. Understanding risk tolerance is equally important, as it guides investment choices and helps manage emotional responses to market volatility.

The Role of Technology in Investment

Technological advancements are fundamentally reshaping the investment landscape. High-frequency trading algorithms, sophisticated data analytics, and blockchain technology are transforming how investments are made and managed. This technological revolution empowers investors with unprecedented access to information and tools to make more informed decisions. The ability to process vast datasets and identify patterns allows for a more precise understanding of market dynamics.

Sustainable Investment Practices

Growing awareness of environmental and social issues is driving a shift towards sustainable investment practices. Investors are increasingly seeking out companies and projects that align with their values, promoting responsible environmental stewardship and social progress. This trend is not just about ethical considerations but also about long-term financial viability. Companies committed to sustainability often demonstrate greater resilience and attract a more discerning customer base.

Global Market Integration

The global economy is becoming increasingly integrated, creating new opportunities and challenges for investors. Understanding the interconnectedness of global markets is crucial for navigating potential risks and capitalizing on emerging opportunities. International diversification plays a vital role in managing risk and potentially boosting returns.

This interconnectedness demands a global perspective, understanding the nuances of different markets and regulations. Investors need to be aware of international political and economic factors that can impact investment returns.

The Impact of Demographics on Investment

Demographic shifts are influencing consumer behavior and market trends. Understanding how these changes affect various sectors is essential for making informed investment decisions. For example, the aging global population presents both challenges and opportunities for the healthcare and retirement sectors. Investors need to anticipate and respond to these shifting demographics to capitalize on emerging market segments.

Risk Management and Portfolio Optimization

Effective risk management is paramount in achieving long-term investment goals. Developing a robust risk management strategy involves identifying potential threats, assessing their impact, and implementing mitigation techniques. Diversification is a crucial component of risk management, spreading investments across various asset classes and geographies to reduce the impact of any single investment loss.

Portfolio optimization techniques can be employed to fine-tune investment strategies, balancing risk and return based on individual investor profiles and goals. This involves careful consideration of asset allocation, diversification, and rebalancing strategies.

Emerging Opportunities and Innovation

The future of investment is dynamic, presenting a wealth of emerging opportunities and innovative approaches. Staying informed about the latest technological advancements, market trends, and policy changes is crucial. Continuous learning and adaptation are essential for success in this ever-evolving landscape.

Investing in sectors like renewable energy, biotechnology, and artificial intelligence holds immense potential for long-term growth. A forward-thinking approach, combined with thorough research, is key to identifying and capitalizing on these new opportunities.

Read more about Green Hydrogen for Corporate Decarbonization: A Future Pathway

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

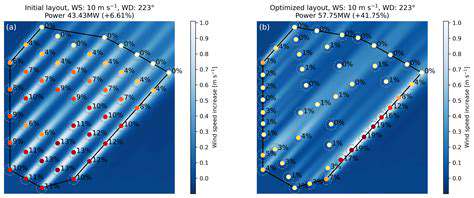

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies