The Global Landscape of Renewable Energy Investment: Trends and Forecasts

Financial Mechanisms and Investment Strategies Driving the Transition

Investment Strategies for Growth

Successful investment strategies are crucial for achieving long-term financial goals. A well-defined strategy considers risk tolerance, financial goals, and time horizon. Diversification is key, spreading investments across various asset classes to mitigate risk and potentially enhance returns. Careful consideration of market trends and economic forecasts is essential for informed decision-making.

Different investment strategies cater to various investor profiles. Conservative investors may prioritize stability and low-risk options like bonds or savings accounts, while aggressive investors might favor higher-risk, potentially higher-reward investments such as stocks or real estate. Understanding these nuances is vital for selecting the right approach.

Debt Financing Options

Debt financing provides a means for businesses and individuals to access capital without relinquishing ownership. Loans from banks, credit unions, and other lending institutions are common methods. Understanding the terms and conditions of these loans, including interest rates and repayment schedules, is crucial for responsible financial management. The availability and terms of debt financing can vary significantly depending on creditworthiness and market conditions.

Exploring alternative debt financing options, such as private loans or crowdfunding platforms, can broaden the range of possibilities. However, it's essential to conduct thorough due diligence and understand the associated risks and rewards before committing to any debt financing arrangement.

Equity Financing Mechanisms

Equity financing involves selling ownership stakes in a company or project to raise capital. Investors provide capital in exchange for a share of future profits or ownership. This can be a powerful tool for growth, providing access to capital beyond the reach of traditional debt financing. Venture capital and private equity firms often utilize this mechanism to fund startups and emerging companies.

Government Incentives and Subsidies

Government incentives and subsidies play a significant role in encouraging investment in certain sectors or regions. These programs often provide financial support for infrastructure development, research and development, or job creation. Identifying and leveraging available government incentives is crucial for maximizing investment returns and achieving economic goals. Government policies and regulations can significantly influence investment decisions and market dynamics.

Understanding the eligibility criteria and application processes for these incentives is vital for successful participation. Researching specific programs relevant to your investment goals can help you identify opportunities to reduce costs and increase potential returns.

Risk Management in Investments

Effective risk management is an essential component of any successful investment strategy. Understanding the potential risks associated with different investment options is crucial for making informed decisions. A comprehensive risk assessment helps in identifying vulnerabilities and developing mitigation strategies. Diversification, hedging, and other risk management techniques can help to protect investments against market fluctuations and unexpected events.

Monitoring investments regularly and adapting strategies as market conditions change is vital. Staying informed about current market trends and economic indicators allows for proactive adjustments to minimize potential losses and maximize returns.

International Investment Opportunities

Exploring international investment opportunities can offer access to diverse markets and potentially higher returns. However, understanding the complexities of international regulations, currency exchange rates, and political risks is essential. International investments often come with greater complexities, and thorough research is vital for informed decision-making. Navigating cultural differences and legal frameworks in foreign markets is crucial for successful investment outcomes.

Thorough due diligence, including understanding local regulations and market conditions, is vital when considering international investment opportunities. Professional advice from experienced international investment advisors can provide valuable insights into potential risks and rewards.

Read more about The Global Landscape of Renewable Energy Investment: Trends and Forecasts

Hot Recommendations

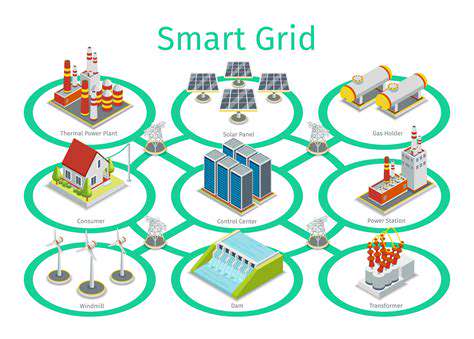

- How Your Rooftop Solar Contributes to the Grid

- Solar Energy for Electric Vehicle Charging Stations

- Offshore Wind Repowering

- Agricultural Solar (Agrivoltaics): Synergies Between Food and Energy

- Airborne Wind Energy: Tapping High Altitude Winds

- Renewable Energy and Green Hydrogen: A Powerful Duo

- Geothermal Power Plant Technologies: Flash, Dry Steam, and Binary Cycle

- The Future of Offshore Wind Transmission

- The Role of Energy Storage in Enhancing Energy Security

- The Environmental Footprint of Modern Wind Energy Advancements: LCA Analysis