The Role of Financing Options in EV Purchase Decisions

Exploring Diverse EV Financing Models

Lease Financing for EVs

Lease financing presents an appealing option for those considering electric vehicle ownership without the hefty upfront costs. Unlike traditional loans, leasing enables drivers to experience the latest EV technology while avoiding long-term depreciation concerns. Monthly lease payments often prove more manageable than loan installments, particularly for those who enjoy upgrading their vehicles every few years. Standard lease durations span 24-60 months, though potential lessees should carefully review mileage limitations that could incur additional fees.

The true cost of EV leasing extends beyond the monthly payment. Lessees must account for potential excess mileage charges and end-of-lease disposition fees. Careful evaluation of annual driving habits can prevent unexpected expenses when returning the vehicle.

Loan Financing for EVs

Traditional auto loans continue to dominate EV financing options for buyers seeking full ownership. This approach provides complete control over the vehicle, including customization options and maintenance decisions without lessor restrictions. The ability to build equity in the vehicle represents a significant advantage over leasing arrangements, though monthly payments typically run higher.

Current market conditions significantly impact loan affordability. Prospective buyers should compare rates across multiple lenders and consider credit union options, which often offer competitive terms for environmentally-friendly vehicle purchases.

Government Incentives and Subsidies

National and local governments worldwide have implemented various programs to accelerate EV adoption. These initiatives range from direct purchase rebates to tax credits and reduced registration fees. Understanding regional incentive structures can substantially lower effective purchase prices, sometimes by thousands of dollars.

Incentive programs frequently evolve, making timely research essential. Some jurisdictions offer additional benefits like HOV lane access or reduced electricity rates for EV charging, creating long-term value beyond the initial purchase.

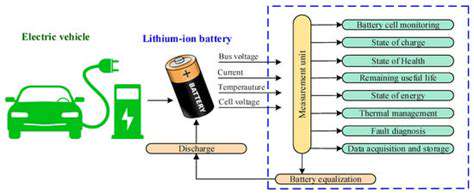

Battery-Specific Financing Options

Innovative financing products have emerged to address EV battery concerns. Some lenders now offer separate financing for battery packs or performance-based terms that account for expected degradation. These specialized options help mitigate concerns about long-term battery performance while maintaining payment affordability.

Battery warranty coverage often extends beyond standard vehicle warranties, providing additional peace of mind. Buyers should carefully review manufacturer battery guarantees when evaluating financing packages.

Bundled Financing Packages

Dealerships increasingly promote comprehensive EV packages that combine vehicle financing with charging equipment and installation services. These bundled solutions simplify the transition to electric mobility while potentially offering cost savings through volume discounts.

Beyond charging solutions, some packages include maintenance plans or connectivity services. Buyers should assess whether bundled components match their actual needs or represent unnecessary additions to the financing agreement.

Financing for Used EVs

The secondary EV market presents unique financing challenges and opportunities. Battery health reports have become crucial valuation tools, with many lenders requiring professional assessments before approving loans. Interest rates for pre-owned EVs often differ from new vehicle financing, reflecting different risk calculations.

Depreciation patterns for electric vehicles continue to evolve as the market matures. Savvy buyers can find excellent values in certified pre-owned programs that include extended warranties and charging benefits.

Government Incentives and Tax Credits: A Powerful Factor

Government Incentives for Renewable Energy

Public sector support mechanisms significantly influence renewable energy adoption rates. These financial instruments take various forms across jurisdictions, from direct installation rebates to production-based incentives. The strategic design of these programs reflects regional energy priorities and available resources, creating a diverse global incentive landscape.

Residential solar programs frequently differ from commercial-scale initiatives, with homeowner-focused incentives emphasizing simplicity and immediate financial impact. Understanding these nuances helps maximize the value of available programs.

Tax Credits for Renewable Energy Investments

Investment tax credits serve as powerful economic levers for clean energy development. These mechanisms effectively reduce capital costs by allowing dollar-for-dollar reductions in tax liability. The multiplier effect of these credits extends throughout local economies, supporting job creation and supply chain development beyond the immediate energy sector.

Some jurisdictions offer carry-forward provisions for unused credits, enhancing their value for projects with variable cash flows. Tax professionals can provide crucial guidance for optimizing credit utilization strategies.

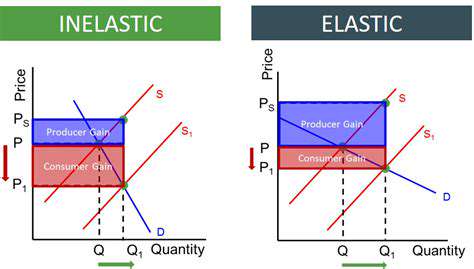

Impact of Government Incentives on the Renewable Energy Sector

Policy support has proven instrumental in scaling renewable energy deployment globally. Well-structured incentive programs create market certainty that attracts private investment and accelerates technological innovation. The resulting economies of scale continue to drive down renewable energy costs, reducing reliance on subsidies over time.

The broader economic impacts extend to workforce development and grid modernization efforts. As renewable penetration increases, incentive programs increasingly focus on integration challenges and storage solutions rather than simple capacity additions.

Long-Term Considerations and Financial Planning for EV Ownership

Long-Term Financial Planning

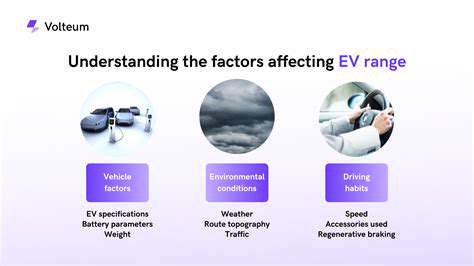

Comprehensive financial planning requires careful assessment of both current circumstances and future objectives. The transition to electric vehicles introduces unique financial considerations, including charging infrastructure costs and potential energy savings. A holistic approach examines these factors alongside traditional automotive expenses.

EV-specific budgeting should account for reduced maintenance costs but potentially higher insurance premiums. These competing factors create a complex financial picture that requires careful analysis.

Investment Strategies

Diversification remains fundamental to successful long-term investing, particularly when incorporating sustainability-focused assets. The growing EV sector presents new investment opportunities across vehicle manufacturers, charging networks, and battery technology firms.

Environmental, Social, and Governance (ESG) factors increasingly influence investment decisions. Many investors now evaluate automotive holdings through this lens, favoring companies with strong EV transition strategies.

Retirement Planning

Transportation costs represent a significant retirement expense category. EV ownership can substantially alter retirement budget projections, with lower fuel costs potentially offsetting higher vehicle payments. Retirees should carefully model these tradeoffs when planning their post-work transportation needs.

The longevity of EV components, particularly batteries, may influence vehicle replacement cycles. These factors should inform retirement budget assumptions about automotive expenses.

Estate Planning

EV ownership introduces new considerations for asset transfer planning. Charging equipment and related home modifications may require special attention in estate documents, particularly for properties with shared charging infrastructure.

Digital asset management grows increasingly important, as many modern EVs rely on connected services. Estate plans should address access to vehicle apps and subscription services.

Tax Implications

EV ownership creates multiple tax planning opportunities. Federal and state incentives may qualify for immediate tax benefits, while charging equipment installations might qualify for energy efficiency credits. Home-based charging costs may also have deductible components for certain taxpayers.

Business use of personal EVs introduces additional tax considerations. Mileage tracking takes on new importance with electric vehicles, as the IRS continues developing guidance for EV reimbursement rates.

Read more about The Role of Financing Options in EV Purchase Decisions

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies