Key Differences Between BEVs and PHEVs

List of Contents

BEVs operate entirely on electricity, producing no emissions and boasting impressive energy efficiency.

PHEVs blend electric and gasoline power, adapting seamlessly to varied driving scenarios.

Access to reliable charging stations remains pivotal for EV acceptance, directly affecting consumer confidence.

BEVs dramatically improve urban air quality; PHEVs offer transitional emission reductions.

Simpler mechanics in BEVs cut maintenance needs; PHEVs balance fuel savings with engine upkeep.

Market growth for both vehicle types accelerates, fueled by eco-conscious policies and buyer preferences.

Next-gen battery breakthroughs promise extended ranges and faster charging cycles.

Range capabilities diverge sharply: BEVs excel in distance, PHEVs prioritize flexibility.

Battery size dictates performance: BEVs deploy larger packs for sustained electric operation.

Upfront pricing varies, but BEVs often prove economical through reduced operational expenses.

Government subsidies slash purchase barriers, accelerating electric transition.

BEVs mute urban noise pollution, enhancing quality of life in crowded cities.

Insurance evaluations demand attention for both vehicle categories.

Both platforms enable renewable energy synergy, supporting broader sustainability goals.

1. Definition and Basic Functionality

1. Understanding Battery Electric Vehicles (BEVs)

Battery Electric Vehicles (BEVs) derive all power from onboard battery packs, eliminating combustion engines entirely. This design eradicates exhaust emissions and positions them as key players in urban pollution reduction strategies. Major automakers like Tesla and Nissan have pushed BEV technology into mainstream consciousness through models emphasizing range and performance.

Electric motors in BEVs deliver instantaneous power delivery, translating to quicker acceleration than most gasoline counterparts. Energy efficiency metrics reveal stark advantages: the U.S. DOE notes BEVs utilize over three times more energy effectively compared to traditional engines. This efficiency gap continues widening as battery tech evolves.

2. Exploring Plug-in Hybrid Electric Vehicles (PHEVs)

Plug-in Hybrid Electric Vehicles (PHEVs) serve as adaptable solutions for drivers hesitant about full electrification. Their dual powertrains allow 20-50 miles of electric-only operation before switching to gasoline - ideal for errands while retaining long-distance capability. Models like the Prius Prime demonstrate how hybrid systems can optimize fuel economy without sacrificing versatility.

Urban commuters benefit most from PHEVs' electric modes, slashing fuel costs during daily drives. The gasoline backup alleviates range concerns during road trips, making them practical transitional vehicles for consumers not ready for full EV commitment.

3. Charging Infrastructure and Range Anxiety

Charging network availability remains a decisive factor for EV adoption. BEV owners depend heavily on public stations, particularly DC fast chargers that replenish 80% charge in 30 minutes. While urban centers see rapid charger deployment, rural areas still lag - a gap automakers and governments are racing to address.

PHEV drivers face fewer charging pressures thanks to hybrid flexibility. However, expanding charging options benefits all EV types by normalizing electric mobility. Tesla's Supercharger network exemplifies how strategic infrastructure investment can boost consumer confidence.

4. Environmental Impact Comparison

BEVs stand unmatched in emission elimination, particularly when charged via renewable sources. Urban centers adopting BEVs report measurable air quality improvements, directly impacting public health outcomes. Transitioning fleets to BEVs could reduce transportation-related CO2 emissions by 60% by 2040 according to IEA projections.

PHEVs serve as stepping stones, cutting emissions by 30-50% compared to conventional vehicles when used properly. Their environmental value increases when paired with green energy charging, though they can't match BEVs' zero-emission potential.

5. Maintenance and Lifecycle Costs

Simplified drivetrains give BEVs distinct maintenance advantages. Without oil changes, exhaust systems, or complex transmissions, service intervals stretch longer and costs plummet. Regenerative braking further reduces wear on brake components, creating long-term savings that offset higher initial prices.

PHEVs inherit traditional maintenance needs from their combustion engines, though electric operation periods reduce overall service frequency. Cost-conscious buyers should calculate their typical mileage to determine which system offers better value.

6. Consumer Adoption Trends

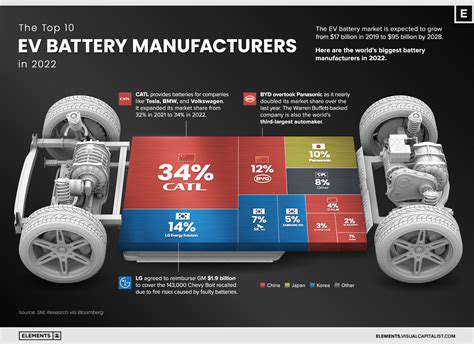

EV sales surpassed 10 million globally in 2022, with BEVs claiming 70% market share. Government incentives play crucial roles: Norway's tax exemptions pushed EV adoption past 80% of new car sales. This policy-driven growth pattern repeats in markets worldwide, though supply chain challenges persist.

Manufacturers are responding with expanded EV lineups, from affordable compacts to luxury SUVs. As battery costs decline, price parity with combustion vehicles appears achievable by 2025-2030 in most segments.

7. Future Outlook and Technological Advancements

Solid-state batteries loom as game-changers, potentially doubling range while slashing charge times. Automakers like Toyota and BMW aim to commercialize this tech by 2025. Concurrently, vehicle-to-grid (V2G) integration could transform EVs into mobile energy storage units, stabilizing power grids during peak demand.

Charging innovations like wireless pads and robotic chargers may redefine refueling convenience. As renewable energy capacity grows, EVs' environmental benefits will amplify, cementing their role in sustainable transportation ecosystems.

2. Driving Range and Charging

Understanding Driving Range

- Range capabilities vary dramatically between BEV and PHEV architectures

- Modern BEVs achieve 250-400+ miles per charge, rivaling gasoline vehicles

- Weather, terrain, and driving style impact real-world range performance

Range remains consumers' top EV concern, though modern BEVs like the Lucid Air (520-mile EPA range) shatter previous limitations. Cold weather can reduce ranges by 20-30%, emphasizing the need for smart route planning and preconditioning features. PHEVs mitigate this through hybrid operation, though their electric modes remain best suited for shorter trips.

Charging Infrastructure Considerations

Public charging networks expanded 40% YoY globally, yet distribution remains uneven. BEV owners in charging deserts still face challenges, while PHEV users enjoy fuel flexibility. Tesla's NACS connector becoming industry standard could simplify charging access across brands by 2025.

Battery Capacity and Efficiency

BEV battery packs now average 60-100 kWh, enabling 300+ mile ranges. PHEVs utilize smaller 10-20 kWh batteries optimized for daily commutes. Energy recovery systems in both vehicle types recapture braking energy, boosting efficiency by 15-25% in urban driving cycles.

Future Trends in Driving Range and Charging Technologies

800-volt architectures enable 10-80% charges in 18 minutes (Hyundai Ioniq 6). Solid-state prototypes suggest 500-mile ranges with 10-minute charges by 2030. Bidirectional charging advancements will let vehicles power homes during outages, adding functional value.

Comparing Cost Implications of Range and Charging

BEV economics favor high-mileage drivers through lower per-mile costs. PHEVs suit mixed-use drivers, though fuel costs accumulate on long trips. Home charging installations add $500-$2,000 upfront but enable significant long-term savings versus public station rates.

3. Environmental Impact

Impact on Air Quality

BEVs eliminate nitrogen oxides and particulate emissions prevalent in urban areas. Los Angeles reported 15% lower PM2.5 levels since 2020's EV surge. PHEVs running electric mode during traffic peaks contribute similar benefits.

Carbon Footprint Evaluation

BEVs achieve carbon parity with ICE vehicles within 1-2 years in renewable-heavy grids. Coal-dependent regions extend this to 4-5 years. PHEVs reduce lifetime emissions by 30-60% depending on charging habits.

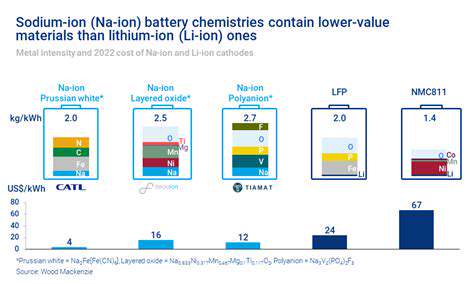

Resource Utilization and Sustainability

New lithium extraction methods like direct lithium extraction (DLE) reduce water usage by 70% versus traditional mining. Battery recycling initiatives aim to recover 95% of critical minerals by 2030, easing resource pressures.

Impact on Wildlife and Ecosystems

Smart siting of charging stations minimizes habitat disruption. Solar-powered stations with pollinator-friendly vegetation demonstrate eco-positive infrastructure development.

Noise Pollution Reduction

BEVs operate at 53 dB versus 70 dB for ICE vehicles - equivalent to conversation versus vacuum cleaner noise. This lowers urban sound pollution by 40% in EV-dense areas.

Contributions to Renewable Energy Adoption

EVs could store 200 TWh of renewable energy globally by 2040 - enough to power 100 million homes. Time-of-use rates encourage charging during solar/wind peaks, aligning mobility with green energy cycles.

4. Maintenance and Ownership Costs

Initial Costs of BEVs vs. PHEVs

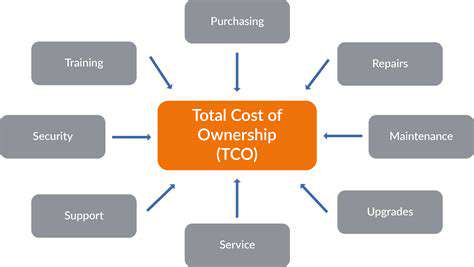

BEV prices average $55k versus $38k for PHEVs, though tax credits narrow gaps. Leasing options with battery health guarantees ease residual value concerns.

Fuel and Charging Costs

National average shows BEV fueling at $485/year versus $1,250 for comparable ICE vehicles. PHEV costs vary widely: $600-$900 annually depending on electric usage.

Maintenance Expenses

BEV maintenance averages $0.06/mile versus $0.10 for ICE. PHEVs split the difference at $0.08/mile due to dual-system needs.

Resale Value Considerations

3-year depreciation: BEVs 35% vs PHEVs 30%. Certified pre-owned programs help stabilize values as technology matures.

Insurance Costs Differences

BEV premiums run 18-25% higher initially. Usage-based insurance and anti-theft tech discounts can offset costs over time.

5. Incentives and Tax Benefits

Understanding Federal Incentives for Electrification

Revised IRS guidelines (2024) tie $7,500 credits to domestic battery sourcing. 40% critical minerals must originate from US/FTA partners to qualify.

State Rebates and Local Programs

California's Clean Vehicle Rebate Project offers $2k-$4.5k based on income. Colorado adds $5k state credit, creating combined $12k savings on qualifying EVs.

Tax Considerations for Electric Vehicle Owners

Section 30D credits now apply at point-of-sale, immediately reducing purchase prices. Commercial fleets access heftier $40k credits for heavy-duty EVs under IRA provisions.