The Impact of Government Mandates on EV Adoption

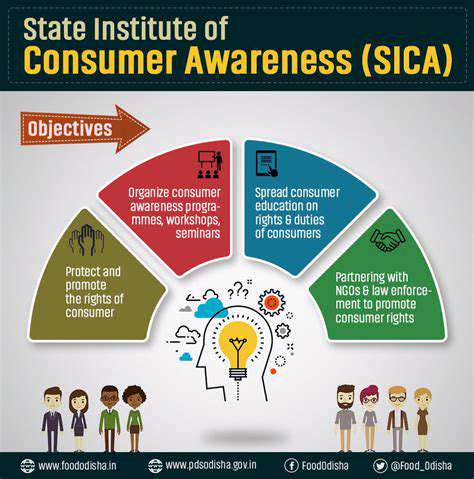

Consumer Education and Awareness Campaigns

Understanding Consumer Rights

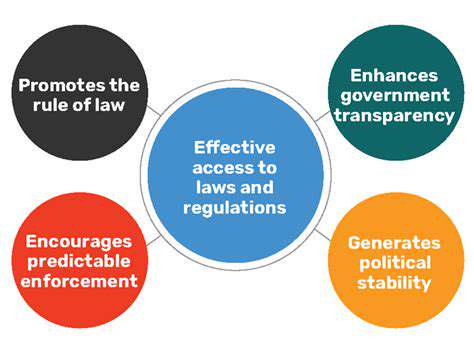

Consumers have a multitude of rights that protect them from unfair or deceptive business practices. These rights are crucial for ensuring a fair marketplace and empower consumers to make informed decisions. Understanding these rights is the first step toward becoming a responsible and empowered consumer. It's essential to know your rights so you can confidently navigate the complexities of the consumer landscape. Knowing your rights can save you from financial harm and protect your interests.

These rights often include the right to safety, to be informed, to choose, and to be heard. Consumers have the right to expect products and services to be safe for their intended use. They also have the right to access accurate and complete information about the products and services they are considering purchasing. Furthermore, consumers have the right to choose between different products and services without undue pressure or coercion, and the right to express their concerns and complaints to businesses and regulatory bodies.

Importance of Product Research

Thorough product research is vital for informed purchasing decisions. It allows consumers to compare features, prices, and quality ratings across different products and brands. This research process helps avoid impulse purchases and ensures that consumers make choices aligned with their needs and budget. Comprehensive research helps consumers make smart, well-informed decisions that save them money and frustration.

Consumers can leverage various resources for product research, including online reviews, comparison websites, and product specifications. By carefully evaluating the available information, consumers can make well-informed decisions and avoid costly mistakes. Understanding the nuances of different product features can significantly impact the overall user experience.

Navigating Advertising and Marketing Strategies

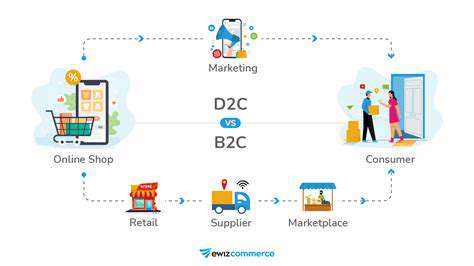

Advertising and marketing strategies can significantly influence consumer decisions. Understanding how these strategies work can help consumers to identify potential biases and make more objective choices. Consumers should be aware of persuasive techniques used in advertising, such as emotional appeals, testimonials, and bandwagon effects. By understanding these tools, consumers can better evaluate the claims made by advertisers and make more rational choices.

Consumers should be critical of advertising messages and not rely solely on promotional materials. It's important to seek out independent reviews and compare products based on objective criteria. By developing critical thinking skills related to advertising, consumers can protect themselves from misleading or manipulative marketing tactics.

Financial Literacy and Consumer Debt

Financial literacy plays a crucial role in responsible consumer behavior. Consumers with strong financial literacy skills are better equipped to manage their budgets, avoid excessive debt, and make informed financial decisions. Understanding financial concepts like budgeting, saving, and investing is key to achieving long-term financial well-being. This knowledge empowers consumers to make sound choices about their finances, avoiding unnecessary debt and financial struggles.

Debt management is a significant aspect of consumer financial literacy. Consumers should understand the different types of debt, the associated interest rates, and the potential long-term consequences of accumulating debt. Having a clear understanding of debt management strategies empowers consumers to make responsible financial choices. This knowledge helps consumers avoid becoming overwhelmed by debt and maintain financial stability.

Read more about The Impact of Government Mandates on EV Adoption

Hot Recommendations

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies