Comparing Subscription Models and Lease Options for EVs

Understanding the Subscription Model

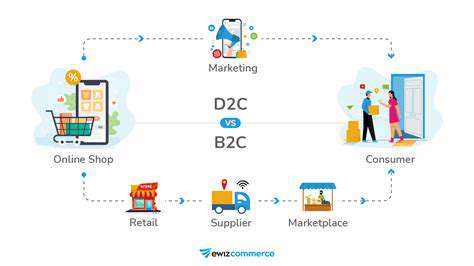

In today's rapidly evolving marketplace, subscription services have emerged as a dominant force across multiple sectors. These services create a symbiotic relationship between providers and consumers, offering consistent value in exchange for predictable revenue. The shift from transactional purchases to relational engagements represents a fundamental change in consumer behavior. For businesses, mastering this model requires deep understanding of customer psychology and value delivery mechanisms.

While the recurring revenue potential is attractive, companies face unique operational challenges in maintaining subscription programs. Continuous innovation and exceptional service delivery become non-negotiable requirements rather than competitive advantages in this model. The dynamic nature of subscriptions demands constant attention to customer satisfaction metrics and product evolution.

The Benefits for Businesses

Organizations adopting subscription models gain several strategic advantages. Predictable cash flow transforms financial planning from reactive to proactive, enabling more confident investment in research and development. This financial stability creates opportunities for enhancing product offerings and customer experience simultaneously.

Perhaps more importantly, subscriptions cultivate enduring customer relationships. This ongoing engagement provides invaluable data and feedback loops that inform product roadmaps and market positioning. The resulting customer intimacy often translates to higher lifetime value and reduced churn rates.

Customer Loyalty and Retention

Successful subscription services prioritize relationship-building over transactional interactions. Creating memorable experiences through personalized engagement becomes the cornerstone of retention strategies. Tactics like member-exclusive benefits and anticipatory service create emotional connections that transcend mere utility.

Proactive communication and rapid issue resolution demonstrate commitment to customer success. Regular touchpoints and value-added interactions reinforce the subscription's worth and discourage cancellation consideration.

Variety of Subscription Options

The subscription landscape now encompasses nearly every consumer and business need imaginable. From digital content platforms to curated physical goods deliveries, the model's versatility enables creative market segmentation. Successful providers identify underserved niches and craft tailored offerings that resonate with specific demographics.

Pricing Strategies and Models

Effective subscription pricing requires balancing value perception with sustainable margins. Tiered structures accommodate diverse customer needs while maximizing revenue potential. Market analysis must inform pricing decisions, ensuring competitiveness without compromising profitability.

Managing Customer Expectations

Transparent communication forms the foundation of successful subscription relationships. Clear articulation of benefits and limitations prevents disappointment and builds trust. Comprehensive onboarding processes and readily accessible support resources demonstrate commitment to customer success.

The Future of Subscription Services

The subscription economy continues to expand into new verticals and markets. Emerging technologies like AI and machine learning will enable increasingly personalized experiences. Providers must remain agile, adapting offerings to meet evolving consumer expectations and technological possibilities.

International travel documentation requires careful preparation. Passport validity extending six months beyond planned stays is mandatory for most international destinations. Travelers must verify page requirements for visas and entry stamps, as insufficient space can disrupt travel plans. Damaged or expired documents should be renewed well in advance to avoid processing delays.

Comparing Monthly Costs and Long-Term Expenses

Understanding Monthly Costs

Comprehensive expense analysis forms the bedrock of sound financial management. Detailed tracking of housing, utilities, and discretionary spending reveals patterns and opportunities for optimization. This granular understanding enables informed decision-making about resource allocation and savings strategies.

Regular expenditure reviews surface spending habits that might otherwise go unnoticed. Identifying and addressing inefficient spending creates room for financial growth and stability. The discipline of monthly analysis cultivates financial awareness that pays dividends over time.

Long-Term Financial Implications

Monthly spending decisions accumulate into significant financial consequences. Consistent attention to cash flow management directly impacts wealth accumulation and debt reduction. The compounding effect of prudent monthly choices can dramatically alter long-term financial trajectories.

Understanding the relationship between present spending and future security enables better decision-making. Each financial choice represents an investment in or withdrawal from future stability. This perspective helps prioritize essential expenditures and identify discretionary spending that could be redirected toward goals.

Factors Influencing Monthly Costs

Numerous variables shape household expenditure patterns. Geographic factors including local tax structures and cost of living create baseline differences. Lifestyle choices regarding transportation, entertainment, and dining represent significant discretionary spending categories that warrant regular evaluation.

Economic conditions like inflation and interest rate fluctuations require budget adjustments. Periodic review of these external factors ensures spending plans remain realistic and aligned with current circumstances.

Strategies for Managing Costs

Effective cost control begins with systematic evaluation of recurring expenses. Regular comparison shopping for essential services can yield substantial savings without sacrificing quality. Alternative transportation methods and strategic meal planning represent additional opportunities for meaningful reductions.

Technology tools provide powerful assistance in expenditure tracking and analysis. Automated categorization and reporting features transform raw data into actionable insights. These systems facilitate ongoing monitoring and timely adjustments to spending patterns.

Comparing Monthly and Long-Term Costs

The true cost of financial decisions emerges when viewed through both short- and long-term lenses. Immediate savings must be weighed against potential future benefits to make fully informed choices. This dual perspective helps identify false economies and prioritize expenditures with lasting value.

Regular alignment of current spending with future goals creates financial coherence. This practice transforms budgeting from restriction to empowerment, ensuring each dollar contributes meaningfully to personal and financial objectives.

Factors Influencing Your Choice

Factors Affecting Subscription Model Decisions

Usage patterns fundamentally determine subscription viability. Frequent users typically benefit from subscription economics, while occasional users may find traditional purchases more cost-effective. The inclusion of support services and regular updates often tips the balance toward subscription models for technology products.

Financial Considerations and Budgeting

Thorough financial analysis should precede any subscription commitment. Projecting total cost of ownership across multiple years reveals the true financial impact. This long-view approach prevents budget surprises and ensures alignment with overall financial strategy.

Technological Advancements and Product Evolution

The accelerating pace of innovation makes access to current technology increasingly valuable. Subscription models often provide seamless transitions to improved versions, eliminating the obsolescence risk inherent in outright purchases. This advantage proves particularly significant in fast-moving technical fields.

Scalability and Flexibility Needs

Business growth and seasonal fluctuations create varying resource requirements. Subscription services offering elastic capacity accommodate these changes more efficiently than fixed-asset models. The ability to scale services precisely to current needs represents a compelling advantage.

Product Features and Service Level Agreements

Detailed evaluation of included features ensures alignment with operational requirements. Clear understanding of performance guarantees prevents disappointment and ensures critical needs will be met. This analysis should weigh both current capabilities and roadmap commitments.

Customer Support and Vendor Reliability

The quality of vendor support often determines subscription success. Responsive, knowledgeable assistance transforms potential frustrations into positive experiences. Vendor stability and market reputation provide important indicators of long-term service quality.

Read more about Comparing Subscription Models and Lease Options for EVs

Hot Recommendations

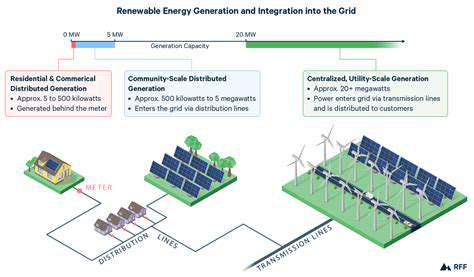

- Offshore Wind for Industrial Power

- Agrivoltaics: Dual Land Use with Solar Energy Advancements: Sustainable Farming

- Hydrogen as an Energy Storage Medium: Production, Conversion, and Usage

- Utility Scale Battery Storage: Successful Project Case Studies

- The Role of Energy Storage in Grid Peak Shaving

- The Role of Startups in Renewable Energy

- The Role of Blockchain in Decentralization of Energy Generation

- The Future of Wind Energy Advancements in Design

- Synchronous Condensers and Grid Inertia in a Renewable Energy Grid

- Corporate Renewable Procurement for Government Agencies