Sustainable urban logistics solutions

Public-private partnerships (PPPs) represent a powerful mechanism for leveraging the strengths of both the public and private sectors to achieve shared goals. By combining the public sector's expertise in policy and regulation with the private sector's innovation and efficiency, PPPs can lead to more effective and sustainable outcomes. This collaborative approach often fosters a more dynamic and resourceful approach to tackling complex challenges.

These partnerships are particularly beneficial in infrastructure development, where the private sector's financial resources and technical capabilities can complement the public sector's land acquisition and regulatory oversight. This synergy can lead to faster project completion and improved quality, ultimately benefiting society as a whole.

Identifying Potential Project Areas

Careful consideration must be given to the selection of appropriate project areas for PPPs. Projects that align with strategic public policy objectives, offer demonstrable economic benefits, and possess a clear delineation of roles and responsibilities for both partners are more likely to succeed. Thorough due diligence and a comprehensive feasibility study are crucial for identifying projects with high potential for success.

Evaluating the risk associated with each project is paramount. This includes assessing market risks, regulatory uncertainties, and financial risks. A robust risk assessment helps to mitigate potential challenges and ensure that the project remains financially viable throughout its lifecycle.

Defining Roles and Responsibilities

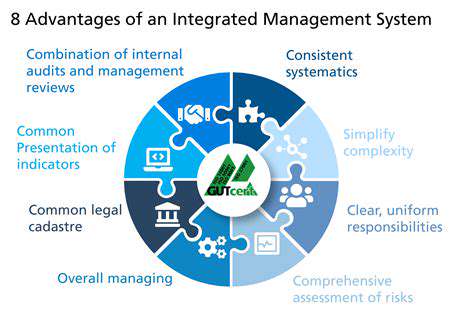

Clearly defining the roles and responsibilities of each partner is essential for a successful PPP. This includes outlining the specific tasks, deliverables, and performance metrics for both the public and private sector. A well-defined framework ensures transparency and accountability, fostering trust and cooperation throughout the partnership's lifespan.

This definition must include provisions for dispute resolution and conflict management, ensuring that any disagreements can be addressed effectively and efficiently. Clear communication channels and a dedicated project management team can streamline the process and maintain the momentum of the partnership.

Financial Structures and Funding Mechanisms

The financial structure of a PPP is a critical aspect that needs careful consideration. The structure should reflect the specific project needs and risk profile, ensuring a sustainable and equitable financial arrangement for both partners. This includes exploring various funding mechanisms, such as public-private capital investments, to ensure long-term financial viability.

Risk Management and Mitigation Strategies

Effective risk management is essential for the success of any PPP. A comprehensive risk assessment should identify potential risks and develop mitigation strategies to address them proactively. This proactive approach can significantly reduce the likelihood of project delays, cost overruns, and other unforeseen issues. This should include provisions for contingency planning and financial safeguards.

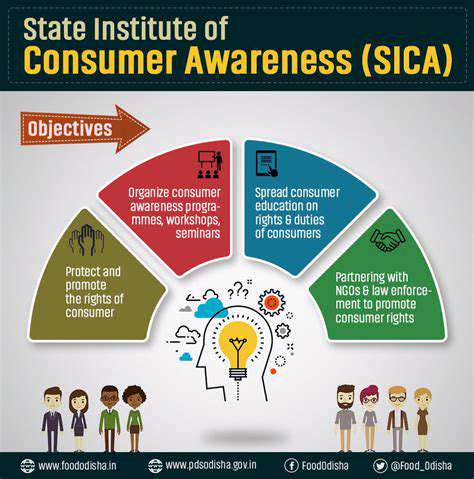

Transparency and Accountability Measures

Ensuring transparency and accountability throughout the PPP lifecycle is vital for building public trust and fostering long-term success. This includes regular reporting on project progress, financial performance, and any potential risks. Open communication channels and robust reporting mechanisms are critical for maintaining public trust and ensuring the project's integrity.

Monitoring and Evaluation

Continuous monitoring and evaluation of the PPP's performance are necessary to ensure that it remains aligned with its objectives and delivers the expected benefits. This includes assessing the project's impact on the community, its economic benefits, and its environmental sustainability. Regular evaluation allows for adjustments to be made as needed to optimize outcomes and maintain the partnership's effectiveness.